Over the past few years, we have frequently written on Xenon Pharmaceuticals (Nasdaq: XENE) and how it had withstood the biotech headwinds better than most. However, it recently swooned to a 52-week low, proving it was not immune to the negative investor sentiment that has consumed the sector. Even while at, or near, 52-week lows, Xenon carries a healthy $2b market cap, a reflection, in our opinion, of the trust investors have in their late-stage lead asset XEN1101 for epilepsy and the company’s robust >$600mm treasury. There is, however, another piece to the Xenon valuation puzzle, something biotech investors covet even more than cash…….catalysts. Xenon has two data readouts expected before year-end, one from a Phase 2 study with XEN1101 in depression (guided for late-Nov to mid-Dec) and a second from a Phase 2 study with their partner, Neurocrine Biosciences (Nasdaq: NBIX), with the sodium channel blocker, NBI-921352 (formerly XEN901), in epilepsy (guided Nov). Even in this difficult tape, Xenon may have a formula that works, a combination of investor confidence, cash, and catalysts, that could see the stock re-test previous highs before year-end.

Xenon’s lead asset, XEN1101, is a small molecule potassium channel opener in Phase 3 development for two different seizure disorders. We will not belabor the merits of XEN1101 (investors wanting to understand better the history can read our earlier notes on Xenon starting back in 2019) other than to say the drug has demonstrated robust anti-seizure activity in an earlier Ph2b epilepsy study. These Phase 2b data underpin investor confidence in a likely positive outcome for Xenon from their ongoing Phase 3 studies with XEN1101 in epilepsy. Although the company hasn’t specifically guided when the first of their three ongoing Phase 3 epilepsy studies will conclude, we estimate the earliest would be late 2024 and more likely sometime in 2025. Assuming success in Phase 3, XEN1101, given its differentiated profile versus exiting commercial anti-epileptic drugs, has the potential to be >$1b annual sales asset.

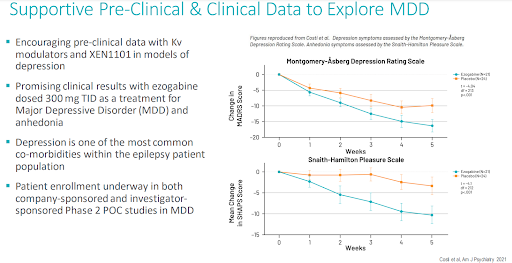

We have previously outlined the rationale and merits for Xenon pursuing XEN1101 in depression in our July 2022 note. To summarize, impressive proof of concept data were presented in 2020/2021, showing the potential benefit of the first-generation potassium channel opener, ezogabine (XEN1101 was built off the ezogabine scaffold), in the management of depression.

These data were the impetus for Xenon undertaking its own 150-patient Phase 2 study with XEN1101 in depression. Positive data from this depression study has several benefits for Xenon, including; (1) another blockbuster indication to pursue with XEN1101 (2) a meaningful source of differentiation for XEN1101 as a commercial epilepsy asset given that depression is the most common psychiatric comorbidity experienced by people with epilepsy (3) and an increase in the pool of potential acquirers for Xenon, as there are far more companies focused on depression than epilepsy. Following and trusting in the data from ezogabine has served Xenon, and investors, well in its epilepsy program with XEN1101, there should be optimism that the same will be true with depression.

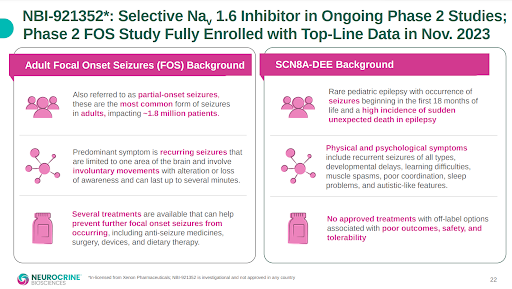

Xenon’s partner Neurocrine has two epilepsy programs running with NBI-921352, the first and more advanced is in focal onset seizures (FOS), and the second is in a rare form of pediatric epilepsy known as SCN8A. Sodium channel blockers are the most common class of drugs used for the management of epilepsy, and NBI-921352 is a selective blocker of the sodium channel 1.6 (Nav1.6). It is believed due to its high specificity for Nav1.6, that NBI-921352, could have profound anti-seizure activity while minimizing off-target side effects (caused by hitting other sodium channels) that plague most current commercial sodium channel blockers.

The 100-patient Phase 2 FOS study is scheduled to report topline data this month. This is the first human efficacy study with NBI-921352, so investors have no previous data to determine the probability of success. However, as noted above, sodium channel blockers are the most common class of drugs used for the management of epilepsy, so mechanistically there is reason for optimism around NBI-921352 in the ongoing Phase 2 FOS study.

Xenon’s Phase 3 epilepsy program for XEN1101 is unquestionably the company’s main asset and what underpins investor confidence in the company. Nonetheless, there’s still much at stake for Xenon with the imminent readouts from their secondary programs with XEN1101 in depression and NBI-921352 in epilepsy. Success in either of these programs should see the stock retest previous highs. There’s certainly more upside in positive XEN1101 depression data, given the company owns 100% of the asset. However, it should be noted that Xenon retains an option to co-fund NBI-921352 development in exchange for higher commercial royalties. It wouldn’t be surprising to see Xenon exercise that right if NBI-921352 is successful in the this FOS study. Where it could get interesting for investors, is if both impending Phase 2 readouts are positive, a scenario that could supercharge the stock.

Even with the downside protection of investor confidence in XEN1101 for epilepsy and the treasury, there’s unquestionably risk to the stock if both these imminent Phase 2 readouts are negative. Although a negative XEN1101 readout in depression has little to no correlation with the probability of success in the Phase 3 epilepsy program, it eliminates the potential for a large label expansion opportunity and what could have been a differentiating attribute for the drug if/when it becomes a commercial epilepsy asset. A Phase 2 setback with NBI-921352 will certainly cast doubt on the pediatric SCN8A epilepsy program also being run by Neurocine and maybe the partnership entirely. It wouldn’t be biotech if there wasn’t risk, but the potential upside of two imminent Phase 2 readouts, with the downside protection of XEN1101 in epilepsy and the treasury, is a formula investors may find attractive.

A Few Quick Takes

Do you announce that topline data from your pivotal study will be available at the largest investor healthcare conference of the year if you aren’t confident in a positive outcome? Asking for a friend…….Cellectar Bioscience (Nasdaq: CLRB)

Sarepta Therapeutics (Nasdaq: SRPT) never disappoints on the drama front. Last week’s mixed data from their pivotal gene therapy study in Duchenne, virtually ensures another year of regulatory intrigue around the company. With Sarepta keeping itself, and Duchenne, top of mind with biotech investors for the foreseeable future, the timing couldn’t be better for a small, upstart company, focused on a novel approach for the management of Duchenne to start its first human studies. Looking at you Satellos Bioscience (TSXV: MSCL, US: MSCLF).

Speaking of starting human studies, Gain Therapeutics (Nasdaq: GANX), recently started its first human study with GT-02287. Although a health volunteer study, the company will be looking at biomarkers to indicate target engagement for GCase that would arguably be predictive of benefit in GBA1 Parkinson’s patients. Data from this study should be available by mid-2024.