Concise Investment Rationale

Gain has an AI-enabled drug discovery platform, SEE-Tx, that is fast approaching having its first drug, GT-02287, enter human studies. GT-02287 has disease-modifying potential for a genetically defined population of Parkison’s Disease patients. Evidence of biological activity with GT-02287 from the upcoming human studies would generate substantial value for Gain shareholders. In the meantime, as investors await data from GT-02287, it seems highly likely Gain will enter into a validating partnership, or finance itself with smart-money funds, affirming the value of the drug and the platform. With a modest $55mm market cap, there could be substantial near-term upside for investors as Gain validates its lead drug and platform.

Primary Value Driver – Potential Disease-Modifying Treatment for Parkinson’s

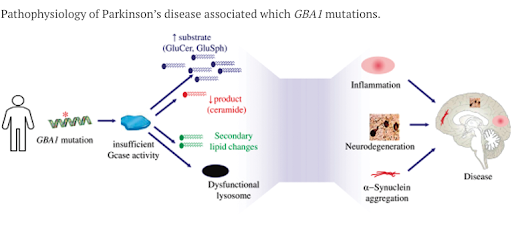

Gain is developing its lead compound, GT-02287, for patients with Parkinson’s Disease who express a mutated GBA1 gene (PD-GBA1). 5-15% of all PD patients will have a GBA1 mutation, making it the leading genetic risk factor for the development of PD. PD-GBA1 patients generally experience an earlier onset and more aggressive form of the disease compared to other PD patients. GT-02287 does not target the GBA1 gene directly, instead, it targets an enzyme that is encoded by GBA1, GCase. When GBA1 is mutated it causes GCase to become unstable and misfold. Once misfolded, GCase is prevented from entering the lysosome and performing its cleaning function, allowing toxic substrates to accumulate in the cell, contributing to dopaminergic neuron death and disease progression.

GT-02287 is a small molecule that binds to an allosteric site (more on this to come) on GCase, stabilizing the enzyme and chaperoning GCase into the lysosome, thereby allowing it to perform its cleaning function and preserving dopaminergic neuron health. GT-02287 has been extensively studied in pre-clinical PD models, demonstrating the potential disease modifying benefits one would expect from increased GCase activity.

There has been substantial academic and industry interest in GBA1 as a pathway to modify the progression of PD. Two notable deals have occurred recently for gene therapy companies targeting GBA1;

- In 2021, Prevail Therapeutics (Nasdaq: PRVL) was acquired by Eli Lilly (NYSE: LLY) for $880mm. Prevail was in Phase 1 with their GBA1 product at the time of the acquisition.

- In 2023, Voyager Therapeutics (Nasdaq: VYGR) entered a collaboration with Neurocrine (Nasdaq: NBIX) focused on their pre-clinical GBA1 product. The deal could total up to $1.5b for Voyager and included a $150mm upfront payment.

By targeting GCase, the enzyme immediately downstream of the GBA1 gene, GC-02287 behaves almost like gene therapy but without the added risks and costs associated with gene therapy. GT-02287 is a highly differentiated asset (small molecule, allosteric binding, targeting GCase), at a similar stage of development to Prevail and Voyager, and should undoubtedly attract substantial investor and/or partnering interest as it enters and progresses through the clinic.

Secondary Value Drivers – GTC-02287 Gaucher, SEE-Tx, and Partnering

Gaucher disease (GD) is a rare lysosomal storage disease caused by insufficient GCase enzyme. There are three types of GD, with types 2 and 3 having neurological involvement. GTC-02287, given its mechanism of stabilizing GCase and ability to cross the blood-brain barrier, is believed to have potential in the management of GD, in particular, the neurological symptoms where there are currently no treatment options. Gain has yet to elaborate on their clinical plans for GT-02287 in GD, but it seems rational to think the company would start efficacy studies in GD in parallel with PD-GBA1, once Phase 1 is complete. It is also worth noting that the potential for GT-02287 could go beyond PD-GBA1 and GD, with GBA1 mutations and GCase misfolding also implicated in Dementia with Lewy Bodies, idiopathic PD and Alzheimer’s Disease.

GT-02287 is Gain’s first structurally targeted allosteric regulator, or STAR, from its Site-Directed Enzyme Enhancement Therapy (SEE-Tx) drug discovery platform. SEE-Tx uses computational simulation to unearth new allosteric binding sites on enzymes and then rapidly screen millions of compounds that may bind to this unique site. Allosteric binding sites are independent of the primary or active binding site that endogenous substrates or ligands bind to on an enzyme. The benefits of allosteric binding versus the active site include;

- Greater site specificity

- Lower probability of off-target effects (side effects)

- Greater versatility and ability to fine-tune protein activity.

These benefits make allosteric binding very attractive to industry but finding these unique sites has proven challenging (most found by accident). If Gain can demonstrate in humans that GT-02287 has a biological impact through its binding of an allosteric site on GCase, the floodgates of industry interest around SEE-Tx should open.

Gain’s leadership team has an impressive history of business development. Gain’s CEO, Matthias Alder, has been involved in approximately $10b of biotech/pharma transactions and Gain’s founder and chairman Khalid Islam was the CEO of Gentium when they were acquired by Jazz (Nasdaq: JAZZ) for $1b. Not surprisingly, Gain’s management has made it known that they are actively exploring a number of possible business development opportunities (listen to the end of CEO Alder’s recent presentation at Opco conference). What’s unknown is whether the partnering interest is focused on GT-02287 or a platform deal for targets generated from SEE-Tx. As discussed above PD-GBA1 programs have generated significant business development interest of late. It’s tough to predict whether Gain’s novel small molecule approach to PD-GBA1 could attract the same level of economics that Neurocrine paid for Voyager’s gene therapy approach, regardless, if Gain were to partner GT-02287, the economics should be very healthy. On the other hand, if Gain were to do a SEE-Tx target-focused deal the economics would almost certainly be more modest, but the company would maintain control over its PD-GBA1 program.

Finance Considerations

The partnering direction, if any, that Gain pursues, will be heavily influenced by their balance sheet and access to capital considerations. At the end of FY22, Gain had $22mm in cash. The company estimates that this cash balance gives them a runway into 2Q24. Gain will need to fortify its balance sheet before YE23, if not sooner, the question is whether it opts for equity or asset dilution. A few possible scenarios;

- Gain signs a SEE-Tx target deal with modest upfront economics, but enough to extend its cash runway for a few quarters. Ideally in this scenario, the partner is relatively high profile such that the equity gets a healthy bump and Gain can quickly raise $20-$30mm, with smart-money funds, at a palatable price, in order to fund GT-02287 deeper into the clinic (no asset dilution, modest equity dilution, validation from partner and capital market)

- Gain signs a deal to out-license GT-02287 with healthy upfront economics, enough to add years of runway to the balance sheet. Gain then looks to accelerate the development of its other pipeline programs (heavy asset dilution, no equity dilution. validation from partner)

- Gain doesn’t do any partnering, instead opting to raise meaningful capital through the capital markets with smart-money funds, in order to fund GT-02287 deeper into the clinic (no asset dilution, heavy equity dilution, validation from capital markets)

In a healthy biotech finance climate, where the cost of capital isn’t excessively onerous for micro-cap biotech companies, Gain would likely opt for equity financing in order to maintain control of its lead asset (scenario 3 above). However, the current biotech finance climate remains tenuous and equity financing for smaller biotech companies generally come with a healthy discount and/or warrant coverage. Gain has managed its cash and cap table very studiously since its 2021 IPO, so it would be surprising to see them take a casual approach to equity dilution. That is likely why the company has put an emphasis on partnering and seems more likely to asset dilute than equity dilute at this time.

Validation

Gain has most of the attributes investors should look for in an early-stage biotech company;

- Novel science

- Entering human studies

- Substantial industry activity and interest in their area of focus

- Platform for pipeline expansion

What Gain needs now is validation. It will take time before we know whether GT-02287 will achieve its potential and become an FDA-approved drug for PD-GBA1, or whether SEE-Tx will become an allosteric drug discovery engine that can churn out novel compounds with regularity. In the meantime, it is important that a partner, investor, or a combination thereof, step up and validate that Gain’s work is worthy of their investment.

As discussed above, Gain has to make a decision on how it finances itself this year, but under most scenarios, investors should win, as long as the money comes from a validating source. With a healthy cash runway, investors can then focus on data readouts for GT-02287 and acceleration of the SEE-Tx generated pipeline.