Satellos in Four Sentences:

Satellos Biosciences is taking a completely novel approach to the treatment of a devastating degenerative muscle disease – Duchenne muscular dystrophy. The company’s lead candidate, SAT-3153, is an oral small molecule with a unique mechanism of action focused on muscle regeneration, whereas other companies are focused on preventing muscle degeneration. Although early, SAT-3153 has the potential to be a front-line, standard-of-care, therapy for the treatment of Duchenne. The combination of a unique mechanism and standard-of-care potential was likely what motivated a number of well-known deep-science funds to invest >US$40mm (CA$55mm) into Satellos, funding the company through its upcoming IND-filing and into human testing next year.

Sarepta Has Raised The Profile Of Duchenne with Investors:

Among biotech investors, Duchenne muscular dystrophy is arguably the most well-known and followed in the category of orphan or rare diseases. Much of the investor attention around Duchenne is attributable to Sarepta Therapeutics (Nasdaq: SRPT) with their $10b market cap, multiple approved drugs for Duchenne, and edgy regulatory strategy. Sarepta’s success targeting muscle fibers with its exon-skipping, and recently gene therapy, approaches to Duchenne, has paved a path for several other companies to follow, such that there are at least a half dozen publicly listed companies taking a similar approach to the treatment of Duchenne. With so much attention and capital, being focused on exon-skipping and gene therapy, it’s no surprise that Satellos, taking an entirely different approach to the treatment of Duchenne, has flown under investors’ radars. That is until recently when Satellos raised >US$40mm from some of the same smart-money funds, like Perceptive Advisors, that were the earliest and most vocal backers of Sarepta in its pre-commercial days.

In 2016 Joseph Edelman, the CEO of Perceptive, one of the largest and best-performing life sciences hedge funds in the world, did an interview with Adam Feuerstein of the Street (now with Stat) about his position in Sarepta Therapeutics. At the time Sarepta had just received accelerated approval from FDA for their first drug to treat Duchenne and Perceptive was their largest institutional holder. Here is a short quote from Edelman recounting his investment in Sarepta (link to the full interview here Edelman AF Interview);

I think we first invested in Sarepta in 2010 when it was AVI Biopharma. It was [Perceptive Chief Investment Officer] Adam Stone’s idea. Stone came to me and said, look at this company. I said, it looks like they’re going broke. Stone told me, no, this company is a long. That was before they had any data in patients…..We’ve been invested in this company for a long time.

Fast forward a few years from now and it wouldn’t be surprising to see a similar quote from Edelman but this time about Satellos, not Sarepta. Perceptive, one of the lead investors in Satellos’ recent deal, clearly doesn’t see the company as a trade (there’s no liquidity), they must view Satellos as a “long” idea. There are countless steps (and trip wires) that Satellos must navigate before it can call Sarepta a true peer, but clearly, some of the smartest minds in biotech investing see the potential for another Sarepta-like return.

Duchenne & Treatment Landscape:

Duchenne muscular dystrophy is a genetic disorder defined by the loss of dystrophin, a protein that is vital in muscle production, structure, and stability. Without dystrophin muscles degenerate – become weak and eventually lose function. Duchenne occurs predominantly in boys. Boys are usually diagnosed between ages 2-5 and gradually lose ambulation over the next 10-15 years. Late-stage Duchenne patients will have degeneration in their heart and lung muscles, which often leads to cardiac or respiratory mortality in their 2nd or 3rd decade of life.

The most commonly used drugs for the management of Duchenne are systemic corticosteroids. These potent anti-inflammatories, are currently considered standard-of-care for Duchenne patients and have been shown to slow muscle weakening temporarily. Corticosteroids, while effective, are known to have serious long-term side effects, most notably weakening of bones and weight gain.

The rapid advancements in genomic-driven drug discovery over the past decade have generated significant optimism among patients, caregivers, and investors, that new disease-modifying treatments for rare diseases, like Duchenne, will be a reality. The first sign that drug discovery had perhaps turned a monumental corner in the management of Duchenne was in 2016 with FDA’s accelerated approval of Sarepta’s Exondys 51. Exondys 51 belongs to a class of drugs known as anti-sense (RNA) and works by a mechanism called exon-skipping. Without diving into too much detail, exon-skipping is believed to work by the drug binding to certain regions of the dystrophin-encoding gene in muscle fiber, allowing defective areas of the gene to be skipped over during protein synthesis, resulting in a functional dystrophin protein being produced. With more functional dystrophin being produced, muscle degeneration should be slowed, which in theory should slow the loss of ambulation in these patients.

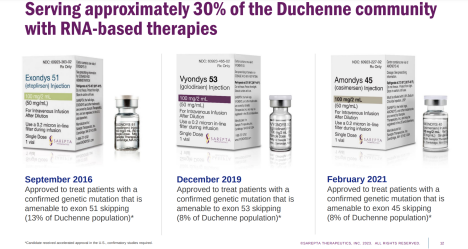

Since the approval of Exondys 51, FDA has granted accelerated approval to three other exon-skipping drugs, Vyondys 53, and Amondys 45 from Sarepta, and Viltepso from NS Pharma. In 2Q23 Sarepta reported combined sales of $239mm for Exondys 51, Vyondys 53, and Amondys 45, putting it a near $1b annual run rate for a portfolio of drugs that address 30% of the Duchenne market.

Earlier this year FDA granted accelerated approval to the first gene replacement therapy for the treatment of Duchenne, Sarepta’s ELEVIDYS. ELEVIDYS is designed to deliver a gene that allows for a mini version of the dystrophin protein to be produced. ELEVIDYS’s approval has been widely celebrated as offering the best chance for functional improvements in Duchenne patients, but confirmatory data on the clinical benefits of ELEVIDYS, or any of the exon-skipping drugs, are lacking at this stage. Remarkably Sarepta has navigated itself through four FDA accelerated approvals, building a commercial portfolio of Duchenne drugs that are trending towards a $1b in annual sales, without giving FDA what it really wants, substantive clinical evidence that their drugs work. This isn’t intended to be criticism of Sarepta, quite the contrary, they should be applauded for pushing the regulatory envelope to get new therapies to Duchenne patients as soon as possible. The intention here is to highlight, the regulatory precedence that has been established by Sarepta that should allow other companies developing Duchenne treatments (a la Satellos) to also exploit.

Satellos Biosciences:

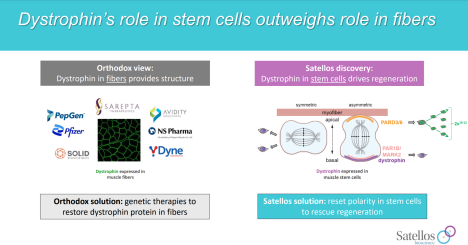

Satellos is taking an entirely novel approach to the treatment of Duchenne by focusing on stimulating muscle regeneration as opposed to slowing muscle degeneration. While Sarepta and others focus on muscle fiber and dystrophin production, Satellos targets muscle stem cells and reinstates their ability to produce new muscle.

Most small biotech companies have their “rockstar” scientist, the person whose findings were the genesis of the company, and in Satellos’ case, that person is Michael Rudnicki. Rudnicki has been at the forefront of muscle stem research for years. While still in academia, Rudnicki discovered that the loss of dystrophin production prevented muscle stem cells from properly dividing and producing new muscle. This was a remarkable finding; up until Rudnicki’s discovery, the scientific dogma was that dystrophin’s role was predominantly to stabilize and protect muscle fibers. Rudnicki’s finding suggested that dystrophin was also responsible for muscle stem cell signaling and new muscle development. The goal now was to see if there was a viable way to drug muscle stem cells, to signal the production of new muscle in the absence of dystrophin. In order to accomplish this, a company needed to be created to bring in additional skill sets, such as medicinal chemistry, finance, etc., and therein was the genesis of Satellos Biosciences.

Satellos went public in August 2021 via a reverse merger on the Toronto Venture Exchange. The timing was far from ideal, as the broader biotech market was in the early innings of what proved to be one of the worst stretches in its history. Not surprisingly, as a discovery-stage biotech company with an approach that didn’t align with the current scientific dogma around Duchenne treatment, Satellos struggled to find an investor audience and capital. Things changed for Satellos earlier this year when they selected a lead compound, SAT-3153, to advance into IND-enabling studies. The company also began releasing pre-clinical evidence of new muscle cell generation and good tolerability with SAT-3153. With a lead compound selected, early signs of efficacy and tolerability, and a clear path toward completion of IND-enabling studies, deep-science investors stepped up to fund the company in May of this year.

SAT-3153 is an oral small molecule that targets a protein known as K9 (not the protein’s real name, the company is keeping that secret for strategic reasons) that is involved in the Notch pathway. Notch is a signaling pathway that is associated with muscle regeneration. As early as 2015, a paper was published in Cell describing how the notch pathway was responsible for certain Golden Retrievers (a species known to be afflicted with muscular dystrophy) who had the Duchenne gene mutation and produced no dystrophin were able to “escape” the disease and live normal lives. The authors cited muscle regeneration as the cause for these escaper dogs having functional muscle even in the absence of dystrophin but were unable to pin down the exact mechanism. Satellos believes they have found the answer, by targeting the K9 protein with SAT-3153, and have early preclinical evidence showing muscle regeneration in pre-clinical models to support their thesis.

Satellos is now running IND-enabling studies with SAT-3153. Over the coming months, investors should see a steady cadence of news from the company as it advances through its pre-clinical testing. The company expects to file its IND with FDA in the first half of 2024 and enter its first human study shortly thereafter. The Phase 1 Single-Ascending-Dose (SAD) study will enroll healthy volunteers and provide preliminary data on the safety of SAT-3153. Assuming SAT-3153 performs as expected in healthy volunteers, the company could be dosing Duchenne patients in a Phase 1b Multi-Ascending-Dose (MAD) study before year end 2024. The MAD study will continue to be focused on safety, but importantly because it’s in actual Duchenne patients, it will also track certain biomarkers that can be predictive of clinical efficacy. Recall that Sarepta has created a precedent whereby early signs of efficacy from biomarkers can open a door for a conversation with FDA about accelerated approval.

SAT-3153’s unique mechanism of action should also allow it to “play well” with other approved Duchenne drugs. Whether it be the exon-skippers or gene therapy, it would appear SAT-3153 would be complimentary to either approach. SAT-3153 also shouldn’t be limited by a patient’s genetic profile (like exon-skippers) or ambulation status (like gene therapy). It is speculative at this early stage of development, but SAT-3153 certainly has the profile of a drug that could become first-line and standard-of-care in the management of Duchenne.

Finance Piece:

Satellos is currently listed on the TSX-Venture as MSCL and on the OTC in the US as MSCLF. The company has approximately 155mm shares outstanding, this includes pre-funded warrants that were part of their May CA$0.50 financing. Satellos disclosed an end of Q2 cash position of CA$49mm and have guided that this gives them cash runway through the completion of Phase 1 (both SAD and MAD). The company has an approximate market cap of CA$60mm/US$45mm and a modest CA$20mm/US$15mm enterprise value. Satellos plans to list on Nasdaq shortly.

Satellos Final Thoughts:

Satellos is at the early stage of its Duchenne journey but that seems to be reflected in its very modest valuation. Despite being early, the company has caught the attention of several smart biotech money managers with its provocative science and should attract even more investor attention as it progresses into the clinic. To quote Joseph Edelman again, this time from a 2018 Forbes article, “Psychology is very important. There is perception and reality. Biotech stocks are driven by whether a drug works…that’s an eight-year process. There are a few single days of events, everything else is a perception of that event.” The “reality” of whether SAT-3153 works may be a few years away, but it feels like the “perception” of Satellos will only trend up from here.

Link to the Edelman Forbes Article Here Edelman Forbes