A Trend We’re Following

To tranche or not to tranche is the question that often faces microcap life science CEOs with vulnerable balance sheets today. The formula goes something like this; a small life science company that needs cash and has one, or more, substantial milestones in its near-term horizon, receives a modest upfront from a group of funds, with a promise (via a warrant) that upon achieving certain future milestones, these same funds will finance the company (via warrant exercise) at a price predetermined at the time of the initial funding announcement. Not surprisingly given the difficult life science tape, these deals are heavily waited in favor of the investor versus the issuer. The funds are often getting multiple warrants connected to clinical data readouts and/or FDA decisions. When these deals are announced, there tends to be an initial uptick in the stock, as investors buy into the finance “certainty” these structures provide (assuming a company meets its milestones) and the validation that comes from having smart-money funds lead the deal. In some cases the initial momentum is sustained through to their first warrant-triggering milestone (see Soleno) and other times, the funds that participated use the momentum to their benefit, to sell some or all of their position in advance of the warrant-triggering milestone, thereby getting a relatively risk-free look at the outcome (see Delcath).

We highlight this finance trend because it relates to a new name that has caught our attention – Cellectar Biosciences (Nasdaq: CLRB). Cellectar recently completed a tranched financing to finance them through a pivotal data readout later this quarter and a potential FDA approval decision next year.

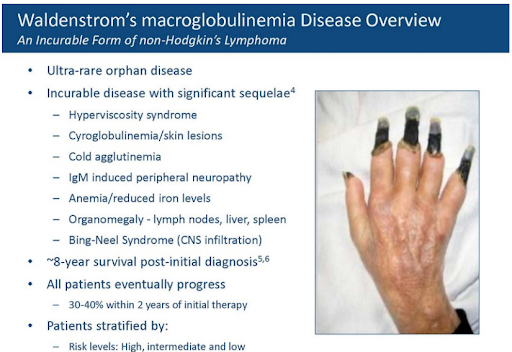

Cellectar has a small molecule radiotherapeutic, iopofosine I 131 (CLR 131), in a single-arm pivotal study in 50 patients with Waldenstrom’s macroglobulinemia (WM), a rare form of non-Hodgkins lymphoma. WM is characterized by an increase of the antibody IgM which causes patients’ blood to thicken, leading to many of the symptoms and complications of the disease.

Cellectar is focused on later-stage patients, those who are refractory BTK inhibitors (BTKi), the standard of care for managing WM. There’s a clear medical need for these later-stage WM patients, and with the benefit of orphan drug pricing, Cellectar believes CLR 131 has the potential to be a $1b+ drug.

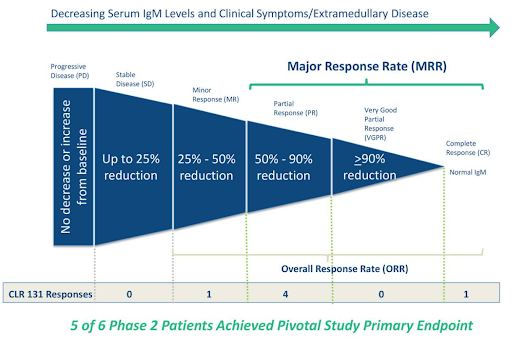

Cellectar has generated proof-of-concept data from an earlier study in 6 late-stage WM patients treated with CLR 131 that showed 5 of 6 patients (83%) achieved a major response (>50% reduction in IgM). The company has guided that topline data from its pivotal 50-patient study will be available this quarter. The study’s primary endpoint is the percentage of patients that achieve a major response and the company has guided that a 20% major response rate (MRR) is the hurdle that CLR 131 needs to clear to meet statistical significance. An MRR of 20% may be statistically significant, but investors we speak with feel the company needs to report an MRR closer to 40% to be clinically significant. Therein lies one of the unknowns around this study and the impending data release, what are investor expectations? A >20% MRR reduction is passable from a stats perspective but, is it underwhelming for investors? Is >40% the real hurdle for investors to consider the data “good”? And what is considered “great” data, a >50% MRR reduction or higher? The investors we speak with feel topline data should fall somewhere in the good to great range, which is supported by the previously reported 6-patient data set.

One last wrinkle for investors to consider is complete responders, WM patients who return to normal IgM levels after treatment. In Cellectar’s earlier study, one patient did have a complete response (CR) after treatment with CR 131. CRs are uncommon in late-stage WM patients, so the percentage of CRs (if any) could carry added weight when investors are interpreting the pivotal data.

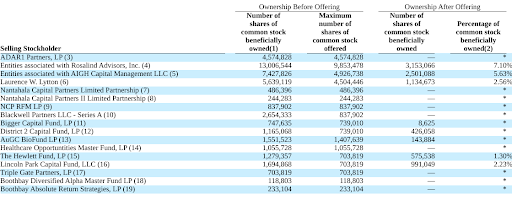

As we mentioned above, Cellectar entered into a tranched financing in September, that included an initial funding of $24.5mm ($1.82/share) and two warrants attached to upcoming milestones. The first warrant, struck at $3.185, is exercisable for 10 days following the company’s release of topline data, and would bring in approximately $44mm. The second warrant, struck at $4.7775, is exercisable for 10 days following the company receiving FDA approval for CLR 131, and would bring in approximately $34mm. In total, assuming all warrants are exercised, Cellectar would issue 34.38mm shares for gross proceeds of $103mm, and because this represents more than 19.99% of the company’s current shares outstanding, the deal was done in preferred shares pending shareholder approval to allow their conversion into common shares. The shareholder vote is scheduled for October 25th. Assuming the shareholders vote in favor, sometime next week 13.46mm shares that were purchased for $1.82 will become free trading.

We know many of these funds and would consider them smart money but as we highlighted in our Delcath note a few weeks ago, that doesn’t mean they can’t be opportunistic and lock in profits, especially when they have a warrant that gives them a risk-free look at the data. It’s definitely something to be mindful of as these new shares become free trading and Cellectar draws closer to its data release.

Perhaps we are overthinking the structure, especially considering how affordable the company is (we estimate the cap to be $85mm) and the above-average probability of Phase 3 success. The company has set a statistical bar that should be achievable, the probability of a complete swing and miss seems low, so the downside seems palatable. The upside from great data could be 3-4x current levels. We can’t say for certain what defines great data but it probably is 50% MRR or higher, with the wild card being CRs. The middle ground, that 40% MRR range, is where the deal structure may weigh on the stock and limit the near-term upside. Make no mistake, 40% MRR is good data, it’s likely approvable data, but not Wow data (at least without a few CRs) and the stock may become range-bound as the finance investors deal with their $3.185 warrants.

There are lots of factors to consider as Cellectar draws closer to top-line data release later this quarter, and we find the setup very interesting. For investors who like playing clinical data readouts, it should be on their radar.

Strange Situation We’re Following

Before we leave the tranched financing story, we would like to quickly draw investors’ attention to a company that entered into a tranched deal back in December 2022 – NLS Pharmaceuticals (Nasdaq: NLSP). NLS has a small molecule, Mazindol ER, in development for narcolepsy and has generated provocative data in a recently completed Phase 2 study. Late last year Biotech Value Fund (BVF), one of the longest-running dedicated life science funds in the U.S., invested $10mm into NLS at $0.87/share. This deal also gave BVF the right to invest another $20mm at $1.50 (unit with 150% warrant coverage) upon NLS successfully completing an end-of-Phase 2 (EOP2) meeting with FDA.

In May of this year, NLS announced they had a successful EOP2 with FDA and had the agency’s blessing to proceed into Phase 3. This announcement opened a 30-day window for BVF to exercise their right to an additional $20mm investment in NLS. At the time the stock was trading in the $1.30 range. Over the next 30 days, the company was completely silent on the BVF right, and not surprisingly the stock price eroded. Then in June, the company announced it was hosting an investor update call, only to postpone it on the day of the call due to “…important developments.” When the call was finally held a week later, it was a non-event and shed no light on the lapsed BVF right. In August the company released a letter from the CEO, where they reference the validation of the initial BVF investment while also acknowledging they don’t have sufficient funds to start Phase 3. Recently NLS announced that it was going to host another investor update call on October 20th to discuss “Strategic Partnerships”, only to once again cancel the call the day before due to “…important developments impacting the timing of the event.”

NLS is a curious situation. In our opinion they have an interesting, Phase 3 ready, drug, targeting an appealing indication, with a modest $20mm market cap. Whatever investor goodwill they earned from the BVF investment has been lost due to their bizarre communication strategy, but that can change quickly with the right announcement. For investors’ sake, let’s hope there is real substance, and capital, behind the partnering carrot they are now dangling, and not just more gamesmanship.

Follow-Up From Previous Notes

Anyone invested or actively following Delcath System (Nasdaq: DCTH) should watch a recent interview with Dr. Jonathan Zager done by the Melanoma Recent Foundation, where he discusses the recent approval of HEPZATO. If you’re already familiar with the Delcath story you can skip straight to the Q&A around the 22-minute mark. We found it very reassuring for the commercial potential of HEPZATO, both near-term and long-term.