Recently a portfolio manager friend, Eden Rahim of Next Edge Capital, circulated a document titled “WHERE BIOTECH IS & WHY HAS IT GOTTEN HERE?” where he describes the plight of biotech investing today and how “…disheartening it is when companies achieve what they set out to, for the reasons one is invested, reporting positive clinical data, achieve regulatory or commercial successes, yet the market either ignores it or punishes them just the same.” (email if you would like a copy) That statement should resonate with Delcath Systems (Nasdaq: DCTH) investors, many of whom, were correct on betting on FDA approval for the HEPZATO KIT, but have thus far been proven wrong on betting on the equity. As longtime champions of Delcath (for a good laugh, here is a link to our Oct 2020 report on Delcath), we have clearly been disappointed with the share price since HEPZATO’s approval. It’s easy to blame the horrible biotech tape for Delcath’s malaise, but there are clearly more factors at play here.

The Financing

If we were to point to one factor that was the predominant reason Delcath didn’t run after the FDA approval it was the financing they entered into in March of this year. There’s no need to belabor the financing itself, other than to say, that the structure clearly weighed on the stock leading up to the PDUFA date and in the 30-day warrant exercise period post-approval. Momentum is a fickle thing, especially with a polarizing name like Delcath, and when the stock doesn’t react as expected (recall FOCUS data release), doubt quickly creeps into what should have been a positive narrative after FDA approval.

Smart Money

In our writing, we frequently reference smart money (sometimes we refer to them as deep-science) funds whose ownership, or lack thereof, helps to inform our interest in a small life science company. As it relates to Delcath, we get asked why some of the smart money funds (BVF, Vivo, etc.), who participated in the March financing and exercised warrants post-approval, appear to be selling off their positions…..clearly, they know something the rest of us don’t. Of course, this same narrative was being thrown around as the stock eroded heading into the PDUFA…..clearly, they know something we don’t. They didn’t have an information edge heading into the PDUFA, and they don’t have an information edge heading into the launch, they’re making decisions based on the same information the rest of us have. The edge they do have, and frankly it’s a big advantage, is the financing structure allowed them to easily lock in profits before and after the PDUFA while taking little to no approval risk. Even though we believe strongly that most of the selling that may have occurred from the funds in the March financing, whether it be pre or post-approval, was simply opportunistic, it has robbed the stock of any positive momentum from the approval and cast doubt on the commercial opportunity.

Doubt has Overtaken Optimism

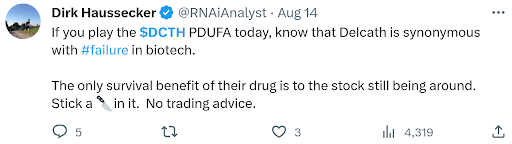

Doubt seems to follow Delcath. Here’s an example from a respected life science investor heading into the PDUFA;

The investor doubt that followed Delcath into the PDUFA has now shifted to the impending commercialization of HEPZATO. The launch, sales process complexity, and training new sites are common investor concerns. Before quickly covering these issues, it is important to state the obvious (which seems to be lost on some people), HEPZATO IS NOT A DRUG. It is a drug-device combination, so by that very definition, investors should discern that there will be differences in the commercialization process for HEPZATO than Immunocore’s (Nasdaq: IMCR) KIMMTRAK, a systemic immunotherapy, which is also approved for mUM.

The launch is expected late this year but realistically the first meaningful glimpse investors will get at HEPZATO sales will be 1Q24. There seems to be concern about the number of sites Delcath will have trained at launch and the pace they can train and add new sites throughout 2024. The company has guided it should have 4-5 sites active by the launch, 10 by midyear, and 15 by the year-end 2024. Our friend, Guy Judkowski of Pufferfish Capital, wrote an excellent piece on Delcath shortly after the approval and has forecasted revenues based on the company’s guided pace of site initiation of $45-50mm in first-year sales for HEPZATO (most sell-side shops have ~$40mm 2024 sales). We should highlight that Guy’s model was based on $150k per procedure, and we now know that the price will be $182.5K, so with this figure, his revenue estimates would be even higher. The investor skeptics highlight that regardless of whether Delcath has revenues of $40mm or $50mm, it still pales in comparison to Immuncore’s $140mm in first-year sales, but again we remind investors HEPZATO IS NOT A DRUG. Furthermore, although HEPZATO’s initial adoption will be slower than KIMMTRAK, its addressable market is almost 2x bigger, which in a few years should see HEPZATO surpass KIMMTRAK in annual sales.

Intertwined in the revenue discussion above is investor concern over the perceived complexity of training new sites to use HEPZATO. Investors may be surprised to learn that the training process that is required to get a new site using HEPZATO was actually volunteered to FDA by Delcath as part of the REMS (risk mitigation strategy) they included with their NDA resubmission. The training and proctoring process for new sites that their CEO Gerard Michel frequently refers to is something that has been standard practice for sites wanting to use Chemosat in the EU. Suffice it to say, that Delcath wasn’t caught off guard by the training requirements to qualify new sites, quite the contrary it is something the company volunteered and planned for.

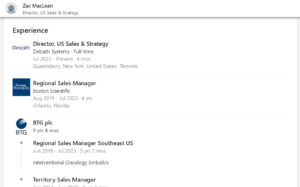

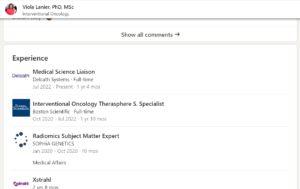

Training is a byproduct of the sale process. “Sites” are in essence a group of specialists (anaesthesiologist, perfusionist, and interventional radiologist) that have collectively decided they want to use HEPZATO. Selling HEPZATO will require a unique multidisciplinary approach. Fortunately, Delcath has a good working knowledge of this multidisciplinary approach from its experience in Europe and, arguably more importantly, through its BTG connection. Delcath’s Chairman, John Sylvester, was the former Chief Commercial Officer at BTG before it was sold to Boston Scientific for $4.2b. One of the BTG’s main products was Theraspheres (frequently referred to as Y90 or SIRT), another liver-directed interventional oncology product that required a multidisciplinary sales approach. Not surprisingly, Delcath has targeted former BTG and/or current Boston Scientific employees with experience selling Y90. Back in 2020, they hired Kevin Muir, ex-BTG/Boston Scientific, as VP of Commercial, and recently at the HCW conference, Gerard mentioned hiring three more former BTG/Boston Scientific sales reps. It appears Delcath is trying to build BTG 2.0.

(found on LinkedIn)

(found on LinkedIn)

Y90, and TACE, are the two other liver-directed therapies that are sometimes used to treat mUM. Both products have inferior profiles to HEPZATO, most notably, neither treatment can be easily repeated and neither treatment can treat the entire liver. Last month Delcath announced that recent retrospective data generated in Europe was presented at a medical conference and showed that patients treated with Chemosat had statistically significant better survival than those treated with Y90. Any wonder reps are leaving Boston Scientific to join Delcath?

Threading the Needle

Like most small companies launching their first product, Delcath will have to balance how much they spend on their initial commercial push with their cash balance. Delcath is in the unique position of having an embedded financing in place, with the final warrant from their March deal triggered upon the company reaching $10mm in quarterly U.S. revenue. Assuming those warrants are fully exercised it would bring in an additional $25mm (4.2mm shares @ $6). Gerard hasn’t specifically guided when he thinks they will hit $10mm+ in quarterly revenue, but he has suggested that the company will reach that milestone before he has exhausted his existing cash. He has publicly stated that with that final $25mm in treasury, there is a good chance the company can get cashflow breakeven without needing to raise additional equity capital.

All indications are that Delcath is well prepared to launch HEPZATO. In fact, we feel that the company is purposefully underselling itself to investors heading into its first commercial year. Gerard’s tone may come across as cautious to some, but all indications point to the company investing heavily in the initial commercial push for HEPZATO. Over the next 12-18 months we believe Delcath can thread the needle between investing (spending) in its commercial business, generating meaningful revenues, bringing in the additional capital from the $6 warrants, and achieving cashflow breakeven. The upside to investors, if Delcath threads the needle as described, is multiples of its current $100mm market cap.

Immunocore’s valuation was >$1b at the time of its 1st quarter sales of slightly over $10mm. Some may argue that we shouldn’t compare Immunocore and Delcath’s valuations, while also preaching their differences (recall HEPZATO IS NOT A DRUG) and emphasizing that investors shouldn’t expect HEPZATO to have the same launch as KIMMTRAK. Perhaps this is true, but in our opinion, the reason for the valuation difference between the companies has less to do with their respective products or commercial dynamics, rather the valuation gap is a reflection of doubt. One company has been given the benefit of the doubt from investors and the other has not. Therein lies the opportunity for investors; Delcath’s valuation reflects investor doubt, but if it executes, if it threads the commercial needle, then it has Immunocore-like upside.