Long-tenured Xenon Pharmaceutical (Nasdaq: XENE) shareholders may have had a blast of nostalgia when the company’s CEO discussed plans to revisit their sodium channel, Nav1.7 program for pain, at their January JP Morgan presentation. It’s been years since Xenon last mentioned Nav1.7. We looked back at our first note on Xenon in 2019 (XENE @ $8.35 FWIW), and we never once discussed Nav1.7 as part of our Xenon investment thesis. Yet, as long-tenured Xenon shareholders can attest, only a few years prior, Xenon’s biggest focus and “claim-to-fame” was their expertise in pain genetics and Nav1.7 drug development.

Coincidentally, a few weeks before Xenon’s JP Morgan presentation, Vertex Pharmaceuticals (Nasdaq: VRTX) had announced positive Phase 2 data for their sodium channel drug targeting Nav1.8, VX-548, in the management of chronic pain, adding a staggering $15b+ in market cap. Then, at the end of the month, Vertex announced Phase 3 acute pain data for VX-548, and although these data weren’t met with the same investor enthusiasm, the company plans to push ahead with an NDA filing later this year. Investors, rightfully so, are excited about novel non-opioid drugs for pain, and Vertex is at the forefront with VX-548, but 7-8 years ago, this title arguably belonged to Xenon and its partners, Genentech and Teva, with their Nav1.7 programs for pain. We will not belabor the history of how Nav1.7 disappeared from Xenon’s pipeline chart; rather, we celebrate its return as an early-stage area of interest for the company and something investors may hear more about in the months and years to come.

Cellectar Biosciences (Nasdaq: CLRB) recently announced that they received $44.1mm from the full exercising of the $3.185 warrants triggered by their stellar pivotal data with their radiopharmaceutical CLR 131 in the rare cancer indication Waldenstrom’s macroglobulinemia (WM). The capital from this first tranche of warrants put Cellectar’s balance sheet in good health, even if it did come at the expense of neutering the momentum in the stock. Importantly, the company is fully financed through the impending NDA process and can invest in its pipeline. Cellectar investors now hope that the stock’s momentum can be rekindled, perhaps by additional data releases in the coming months, which the CEO has already hinted will improve upon the already impressive MRR and CR percentages reported to date.

Delcath Systems (Nasdaq: DCTH) recently announced CMS had established a permanent J-Code for the HEPZATO KIT that comes into effect on April 1st. Having a permanent J-code greatly simplifies the reimbursement and billing process for institutions using, or interested in using, HEPZATO. In the meantime, one center, Moffit Cancer Center, has hit the ground running following HEPZATO’s launch last month.

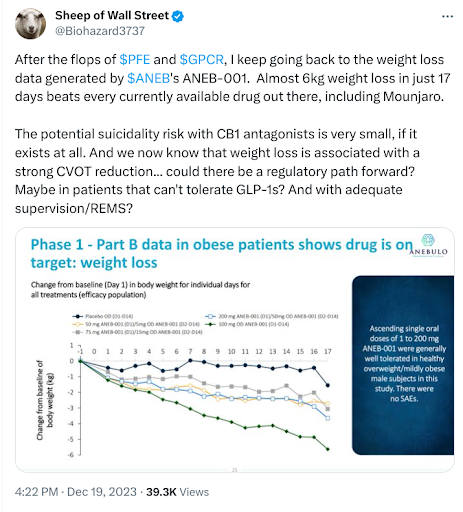

In an October note from last year, we highlighted Anebulo Pharmaceuticals (Nasdaq: ANEB) as a company of interest for their oral small molecule CB1 inhibitor, ANEB-001, for the treatment of acute cannabinoid intoxication (ACI). At the time, the company had stated that it would have data on the last cohort from their Phase 2 ACI study with ANEB-001 before YE23 and that they planned to start their Phase 3 ACI program in 1H24. However, the company never did report data from its final Phase 2 cohort by year-end. In fact, the company has been eerily quiet on all aspects of ANEB-001’s development. Anebulo needs capital to fund its Phase 3 plans in ACI, so perhaps their silence is finance-related, or maybe there is something bigger afoot.

In August 2023, Novo Nordisk (NYSE: NVO) acquired privately held Inversago Pharma for its oral CB1 inhibitor in a deal worth up to $1.1b. Inversago’s CB1 inhibitor had recently completed a Phase 1b study demonstrating its potential for weight loss. Then, last week, Skye Biosciences (OTC: SKYE) completed a $50mm private placement, with participation from Baker Bros and Perceptive Advisors (amongst others), to fund the development of their antibody, nimacimab, a CB1 inhibitor for obesity. All this industry and investor interest in CB1s for obesity got us wondering (again) about Anebulo and a potential pivot into obesity. The tweet below, from a noted life science portfolio manager and former CEO of Anebulo, adds some credibility to the possibility of the company moving into obesity. At this stage, this is sheer speculation, but let’s hope when Anebulo finally does break its silence, it is worth the “weight.”

Keeping with the obesity theme, in our last note, we discussed a curious obesity bet made by notable biotech investors, Adage Capital and Perceptive Advisors, in Veru Inc. (Nasdaq: VERU). Last week, Veru had an IND for enobosarm, its selective androgen receptor modulator (SARM), for managing muscle loss associated with GLP-1 treatment, cleared by FDA. Veru will start a Phase 2b study with enobosarm in combination with GLP-1 therapies in April and expects top-line data before year-end. We highlighted in our Veru note that Viking Therapeutics (Nasdaq: VKTX) also has a development-stage SARM, VK5211, in its portfolio. VK5211 appears to have stalled in the Viking pipeline, but the drug had generated some excellent Phase 2 muscle data, which got us wondering if Viking might also look to study the SARM / GLP-1 combination (validating for Veru). Clearly, we weren’t the only ones thinking this because, on the company’s earnings call last week, the William Blair analyst asked about the possibility of investigating VK5211 in the obesity setting. The CEO of Viking stated this was a “reasonable approach” and an “interesting area” but that the medical necessity was “a bit murky.” It’s difficult to interpret his comments as positive or negative toward the SARM / GLP-1 combination approach, but we take comfort that we weren’t the only ones wondering about this possibility. In the meantime, the early returns on our idea that Veru could be an interesting obesity trade are underwhelming, even after the company’s CEO received free publicity in this NY Times article.

The recent $380mm IPO by bladder cancer-focused CG Oncology (Nasdaq: CGON) was an encouraging sign of the health and momentum that has returned to the biotech market. It was also a good reminder that Protara Therapeutics (Nasdaq: TARA), a company focused on the same area as CG, non-muscle invasive bladder cancer (NMIBC), might be a name worthy of investors’ attention. Comparing CG to Protara because they both have NMIBC programs may be an oversimplistic and lazy approach, but in our opinion, the valuation gap between the two ($2.6b vs. $60mm) is much greater than the clinical gap (we estimate CG is about 18 months ahead of Protara). In our December piece on Protara, we concluded by saying, “We are hesitant to call any micro-cap development-stage biotech a good value, but it’s a label that seems to fit Protara.” We feel this statement holds even more true today post CG IPO.

Last week, Gain Therapeutics (Nasdaq: GANX) presented highly encouraging preclinical data with their lead compound, GTC-02287, in a GBA1 Parkinson’s Disease mouse model at the lysosomal disease-focused Annual WORLDSymposium. It appears investors, and even the media, are starting to pay attention to Gain, as evidenced by this mention on Fox Business.

Although this spike in interest was the result of exciting preclinical data, we remind investors that Gain has transitioned into the clinic and is currently enrolling in a Phase 1 healthy volunteer study with GTC-02287. The company expects to transition from health volunteers into Parkinson’s patients in 3Q24 with the possibility of seeing biomarker data before year’s end.