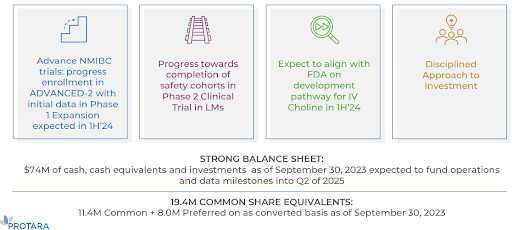

A respected biotech executive, and active investor, we know well, recently suggested we look at Protara Therapeutics (Nasdaq: TARA). Our interest was quickly piqued when we saw a ~$30mm valuation, >$70mm cash (09/30), and an impressive list of smart-money funds, such as Baker Bros and Orbimed in the cap table. The company’s lead program is in non-muscle invasive bladder cancer (NMIBC), which is a difficult indication, and, like most oncology indications, congested with development-stage companies and competitive technologies. However, the company is focused on a population of high-grade NMIBC patients where single-arm studies are sufficient for FDA approval. Protara has several open-label NMIBC studies ongoing, where investors should see a steady cadence of data in 2024. It also has two other programs outside of NMIBC, both in rare diseases, one with an ongoing study with data likely in 2024 and the other expecting regulatory guidance on its development path in 2024. Protara doesn’t have a “big” data reveal in 2024, but what it should have is a steady sprinkling of data and regulatory news throughout the year, which could be appealing for investors, especially on the backdrop of a healthy balance sheet and an improving macro environment for biotech.

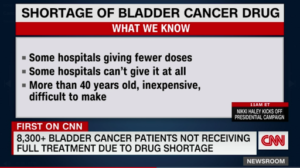

The standard of care for most high-grade NMIBC patients is Bacillus Calmette-Guerin (BCG) an immunotherapy instilled directly into the bladder. BCG, a live attenuated bacteria-based vaccine, is a very effective treatment for NMIBC. Still, recurrence rates are high and the product is frequently in short supply through its only manufacturer Merck.

https://www.cnn.com/2023/02/15/health/cancer-drug-shortage-bcg/index.html

Patients who are unresponsive to BCG or are unable to access BCG, often face a radical cystectomy (removal of the bladder) as their only remaining option. There is a clear need for new treatments to manage BCG-unresponsive patients before they have to proceed to cystectomy and efficacious alternatives to BCG, for those cases where BCG is unavailable.

Protara’s lead drug TARA-002 is similar to BCG, in that it is an immunotherapy (bacteria-based) that is instilled directly into the bladder. TARA-002 is a biosimilar to Chugai Pharmaceutical’s drug OK-432, which is approved in Japan for lymphatic malformations and has been widely studied in several oncology indications, including >100 NMIBC patients. TARA-002 is manufactured from the same master cell bank as OK-432 and should not face supply shortages if approved by FDA.

Protara recently completed a Phase 1a dose escalation study with TARA-002 in NMIBC patients where it determined 40KE (KE is the weight of dried cells in a vial) as the dose for future studies. The company reported that TARA-002 was well tolerated in the 1a study and that there were encouraging signs of drug activity, including one complete response. There is an ongoing expansion cohort (the 1b portion of the study) enrolling up to 12 high-grade NMIBC patients at the 40KE dose. In this high-grade NMIBC patient setting, complete responses are what matters, so investors should focus on the percentage of complete responses in the expansion cohort. The company has guided that data should be available 1H24.

Protara has also started enrolling an open-label Phase 2 study in up to 102 patients with high-grade NMIBC. This study will have two arms, one with up to 27 BCG-naive patients (remember the BCG shortage), and the other with up to 75 BCG-unresponsive patients. The first patient was enrolled in late September, and although the company hasn’t provided any update on enrolment, we expect investors will see some data from this study in 2024.

Protara’s NMIBC program has several moving parts to it, with several potential data releases in 2024. In essence, the company has three studies ongoing, the Phase 1b expansion cohort, the Phase 2 BCG-naive arm, and the Phase 2 BCG-unresponsive arm. All of these studies are open-label, and the company can see data real-time, so we expect investors should see a few data releases in 2024. As we highlighted earlier, the endpoint that investors need to focus on is the same for each study – complete responses.

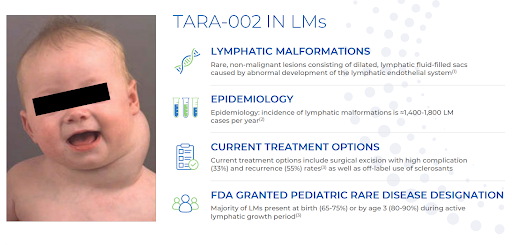

As we mentioned, Protara has two other programs outside of NMIBC. The first is in the aforementioned lymphatic malformations (LM) indication where TARA-002’s predecessor OK-432 is approved in Japan and Taiwan, and it has been used on thousands of patients.

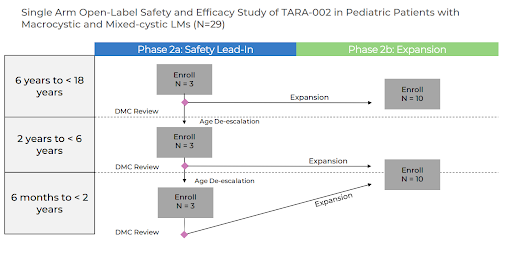

In October of this year, Protara started a Phase 2 study in LM with TARA-002 (injected). The study will start with older children, 6 to <18 years of age, and if the data monitoring committee (DMC) determines the product is safe, the study will step down to 2 to <6 years of age, and then after another DMC meeting, step down to the youngest cohort of 6 months to <2 years of age. If TARA-002 successfully passes all the DMC reviews, the total number of patients in the study should be 29.

At a minimum investors can expect to receive DMC review news in 2024 as TARA-002 hopefully progresses into the younger cohorts. Given the open-label design, it seems likely Protara will also share some efficacy data in 2024, at least from the older cohort. We should also highlight that Protara has received pediatric rare disease designation from FDA, making this program priority review voucher eligible if approved.

The other rare disease program in Protara’s portfolio is IV choline as a substrate replacement for patients on parenteral nutrition (patients being fed intravenously). Although we haven’t spent much time looking into this program, the premise is that PN patients receive insufficient choline in their diets leading to serious liver issues, and IV choline as an exogenous source of choline can support liver health. We expect the company to announce its development plans early in 2024 after meeting with FDA. Investors we have spoken with on Protara, feel there could be sneaky upside from this program if FDA allows them to proceed into a pivotal program with a biomarker endpoint as opposed to a clinical endpoint.

We are hesitant to call any micro-cap development-stage biotech a good “value”, but it’s a label that seems to fit Protara. The company has an appealing pipeline, a very reasonable valuation, and a healthy balance sheet that shouldn’t need to be addressed until later next year. Between now and then, the company should have a steady cadence of clinical and regulatory news, that, if positive, could unlock value for investors. We highlight Protara as a name to watch in 2024.