Follow-up From Our Last Note

In our last note, we highlighted three companies with catalysts that were due to occur before the end of September; Appili Therapeutics (TSXV: APLI, OTC: APLIF), Ocuphire Pharma (Nasdaq: OCUP) and Soleno Therapeutics (Nasdaq: SLNO). Remarkably all three companies had favorable outcomes from their catalysts, but as expected, the market reaction varied tremendously.

Let’s start with Soleno, where we highlighted the potential for a 4-5x return if the company reported positive data from their Ph3 study in Prader-Willi Syndrome. Clearly, we underestimated the upside here, with the stock rocketing up 7x on the day of their positive data announcement. Most of the folks we speak with partly or fully sold into this violent move up. That’s not to say that Soleno doesn’t merit owning over the medium / long term, it is more a reflection that the clinical intrigue has come and gone and there’s less visibility to the next catalyst. The company has guided that it hopes to submit its NDA mid-24, which at best would put their PDUFA date in late-24. We may revisit Soleno next year once we have better visibility on their NDA timing (if FDA convened an advisory committee meeting that could be great biotech theater) but with the the big data reveal behind us, we would rather focus on trying to find the next Soleno.

Both Appili and Ocuphire had their drugs approved by FDA this week but not surprisingly neither was rewarded by the market. In both cases the company had already out-licensed their now-approved asset, meaning the majority of the commercial upside will go to their respective partners. The future royalty streams should provide investors with some downside protection, but we invest in micro-cap biotech for the upside (a la SLNO), so with their PDUFA dates in the rearview mirror, investors can focus elsewhere.

“Perceptive”ness

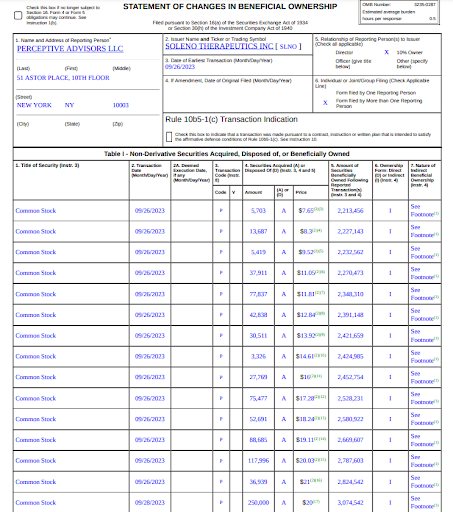

For those who didn’t see our note on Duchenne muscular dystrophy-focused Satellos Biosciences (TSXV: MSCL, OTC: MSCLF) we had fun drawing parallels between Perceptive Advisors recent investment in Satellos and their huge win with their earlier investment in Duchenne pioneer Sarepta Therapeutics (Nasdaq: SRPT). An interesting added piece of information for investors to chew on is that Perceptive was an aggressive buyer of Soleno in May and June, eventually owning over >25% of the shares outstanding heading into data. Subsequent to Soleno reporting data, Perceptive continue to add in the open market and in the $20 financing announced late last week.

One of the most respected dedicated life science funds on the planet, Perceptive reportedly hasn’t escaped the biotech headwinds. Nonetheless, they continue to step up to the plate and take swings at small companies like Soleno and Satellos, and it’s great to see them tag one over the fence again.

A New Name We’re Watching

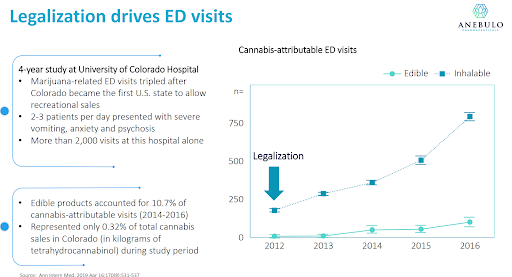

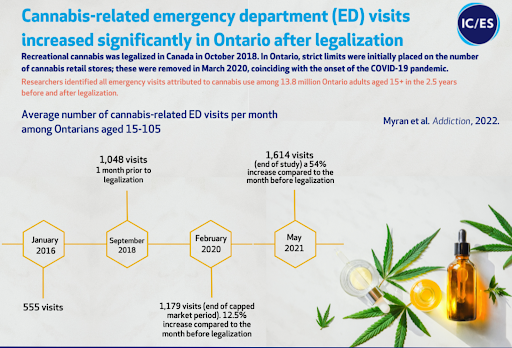

The widespread legalization and liberalization of cannabis throughout North America is directly correlated with an increase in hospital visits for acute cannabinoid intoxication (ACI). There are no approved treatments for the management of ACI but Anebulo Pharmaceuticals (Nasdaq: ANEB) has the most advanced drug in development, ANEB-001. As more jurisdictions legalize cannabis, investors wanting exposure to this sector, but not interested in owning the growers, might want to consider Anebulo as a derivative play on the growth of cannabis use in North America

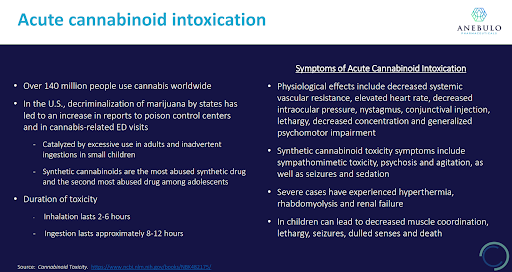

Small children mistaking their parent’s or sibling’s edibles as candies, people consuming a second and third edible because they underestimate the time it takes to metabolize their first, or the increasing availability of ultra-potent synthetic cannabinoids (“spice”) are some of the more common causes of ACI. The symptoms of ACI can present as physiological and/or psychological.

Anebulo estimates that there were over 1.7mm ACI incidences in 2019 in the United States alone, a number that certainly has grown given the expansion of legalization across the country. There is a clear correlation between jurisdictions where cannabis has been legalized and an increase in hospitalizations for ACI.

Most hospitals take a “wait and see” approach to the management of ACI which often leads to patients spending between 6-8 hours in the emergency department. In more severe cases patients may be prescribed benzodiazepines to alleviate psychological symptoms and/or beta-blockers to control heart rate. Anebulo believes ANEB-001 can fill an important need, a fast-acting cannabis “anti-dote” that can treat ACI thereby minimizing the time a patient needs to be in the hospital and freeing up beds for more pressing needs.

ANEB-001 is a small molecule antagonist of the cannabinoid CB1 receptor, the same receptor where THC (the psychoactive component of cannabis) binds. Anebulo has generated strong proof-of-concept data from an ongoing, 134-patient, THC challenge study demonstrating that ANEB-001, given orally, can rapidly (within 1 hour) reverse the symptoms of ACI. The company has already had an end-of-Phase 2 meeting with FDA where they appear to have reached an alignment on the design for a pivotal program. The Phase 3 program should initiate in 1H24 and will include an emergency department study and a larger THC challenge study. If these studies are successful Anebulo believe they will have sufficient data to support an FDA approval for both hospital and community use of ANEB-001. We expect the company will need to raise additional capital to see its pivotal program through to completion.

In the meantime, Anebulo plans to release data this quarter from the final cohort of their Phase 2 study testing ANEB-001 given concurrently with higher doses of THC. It will be interesting to see how these data are received by investors because, unlike the earlier cohorts from the THC challenge study, there is no control arm to compare ANEB-001 against (unethical to expose subjects to such a high dose of THC without concurrent ANEB-001). Yet, the THC doses being used (40 & 60mg) are perhaps reflective of what a real-world emergency patient may have consumed. Strong data from this final cohort could be the catalyst Anebulo uses to raise the capital needed to execute its pivotal program.

Anebulo has approximately 26mm shares outstanding. With its current share price in the low $3s, the company has a market cap close to $80mm. As of June 30th, the company had a little over $11mm in cash.

After a prolonged funk, it appears investors are once again interested in the cannabis sector. As mentioned above, we see Anebulo as an interesting derivative-like play on this growing sector. We think that once fully financed, Anebulo could be a name that gets traction with investors, especially as it progresses through its pivotal program.