What we are about to present is a trade idea. It landed on our radar after we saw this company pivot to focus on one of the biggest medical trends today with the backing of two notable smart money funds, Adage Capital and Perceptive Advisors. Some would consider this company promotional, but that’s part of what makes this idea appealing. Their technology has merit, the indication is extremely topical, they could have data before year-end, they have recently topped up their balance sheet, they carry a modest $60mm valuation, and they aren’t opposed to doing a little hand-waving on occasion.

Veru Inc. (Nasdaq: VERU) is a women’s health company, an oncology company, a COVID company, and most recently, a weight loss company. Late last year, the company surprised investors by announcing they were planning a Phase 2 study with its lead drug, enobosarm, for the prevention of lean body mass (muscle) loss in patients taking the wildly popular Glucagon-like peptide-1 (GLP-1) agonists for weight loss. Prior to this announcement, Veru had been focused on enobosarm’s development as a Phase 3 breast cancer asset. Veru isn’t afraid to chase the indication du jour. Although there is little doubt that opportunism played a big part in this decision to pivot enobosarm into weight loss, it is also, in our opinion, not without some scientific merit.

GLP-1 drugs for weight loss can be indiscriminate toward fat or muscle when accomplishing their tasks. The data vary, but it is estimated between 25-50% of weight loss from GLP-1’s is at the expense of muscle. This can be problematic, especially for older patients. Industry and investor interest in the GLP-1 muscle loss phenomenon was given credence when, in July 2023, one of the GLP-1 front runners, pharma giant Eli Lilly, acquired Versanis Bio for their muscle-sparing myostatin/activin antagonist in a deal worth up to $1.9b. Other companies with myostatin assets, most notably Scholar Rock (Nasdaq: SRRK), Biohaven (Nasdaq: BHVN), and Keros Therapeutics (Nasdaq: KROS), are also planning studies looking at weight loss and muscle preservation. The recent activity around the myostatin class reflects the industry’s interest in addressing the muscle loss problem associated with GLP-1s.

Veru is taking a different approach to managing GLP-1-associated muscle loss. Their lead asset, enobosarm, is a selective androgen receptor modulator or SARM. Enobosarm has a colorful history. Originally developed by GTx in collaboration with Merck, enobosarm was tested extensively for a different muscle-related indication, preventing muscle wasting in cancer patients (cancer cachexia). The Phase 2b data for enobosarm in cancer cachexia were mixed but presented as positive by GTx. Still, there were skeptics, most notably Merck, who ended their collaboration with GTx after digesting the data, and life science journalist Adam Feuerstein, who penned a scathing piece while at The Street, questioning the quality of the enobosarm data presented by GTx.

(link here)

Undeterred, the company pushed ahead with two Phase 3 studies with enobosarm in cancer cachexia. In 2013, GTx reported that although enobosarm demonstrated some encouraging muscle preservation data in exploratory analyses, the primary endpoint in the Phase 3 study was not met, and the company ceased to pursue the indication. In total, enobosarm was tested in five different muscle-wasting studies, generating what we would describe as mixed results.

Fast forward to 2020, and the former CEO of GTx, Mitchell Steiner, who oversaw enobosarm’s development, is now the CEO of Veru. Veru in-licenses enobosarm, which had recently failed a Phase 2 stress urinary incontinence study under GTx, and begins testing it for breast cancer. That drags us up to almost the present day because as recently as this past September at a Cantor Fitzgerald fireside chat webcast, Steiner was still focused on enobosarm as a breast cancer asset. Two weeks after the Cantor webcast, Veru pivoted into the GLP-1 arena with a press release espousing the historical data for enobosarm in muscle preservation and announcing the company’s plans to start a Phase 2 obesity study.

It’s easy to look at Steiner’s history (with GTx and Veru) and suggest that this move into the obesity market is rooted in opportunism rather than science. Although there is little doubt that opportunism is a big part of this decision to pursue obesity with enobosarm, it is also, in our opinion, not without some scientific merit. The historical muscle-preserving data from enobosarm may be ambiguous, but mechanistically, SARMs are believed by many to benefit muscle and bone health.

This list of SARM attributes above doesn’t come from Veru; rather, it is from Viking Therapeutics (Nasdaq: VKTX), who demonstrated statistically significant improvements in muscle mass with their SARM, VK5211, in a Phase 2 hip fracture study from 2018. As we highlighted above, Veru’s historical muscle preservation data are mixed, certainly nowhere near as clean as those delivered by Viking, albeit in completely different indications. Nonetheless, in our opinion, the mechanistic rationale for combining a SARM with GLP-1 to prevent muscle loss has merit.

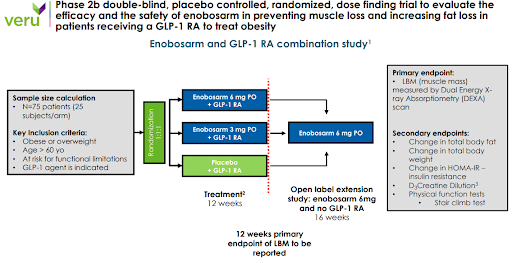

Veru announced on January 8th that it had submitted an IND with FDA for enobosarm in obesity. FDA has 30 days to raise concerns about Veru’s plans; otherwise, the IND should clear on February 8th. Assuming the IND clears on time, the company appears ready to move into a 75-patient Phase 2 study quickly. Veru has guided that it expects top-line data in the fourth quarter.

Why Veru Will Work as a Trade

Investors should look at Veru not as a clinical bet but as a bet that their new weight loss/muscle preservation narrative will find an audience. If biotech can recapture some of its early-year momentum, attracting more generalist money, Veru is a very good generalist story. Investor and media interest in GLP-1s isn’t dissipating soon, and the noise around GLP-1-associated muscle loss is likely to increase.

The myostatin muscle preservation narrative has certainly found an audience. Scholar Rock and Keros surged after announcing their entrance into the GLP-1 muscle preservation arena. What if Viking, a much higher profile biotech company than Veru, decided to investigate their SARM, the aforementioned VK5211, for obesity? They already have a development-stage GLP-1 asset, so is it a stretch for them to consider testing the two mechanisms together? It could be nice validation for Veru.

Veru also isn’t afraid to be promotional. We know that’s a dirty word for some investors, but when you’re only “renting” the stock, you want the company to be loud. Look no further than Veru’s announcement of their IND filing for evidence of this behavior. It is considered by many to be bad form and unnecessarily risky to announce the filing of an IND. However, it is not uncommon for smaller, scrappier companies to announce a filing to keep themselves topical in hopes of getting a stock lift. It didn’t work in the case of Veru, but it speaks to their mindset.

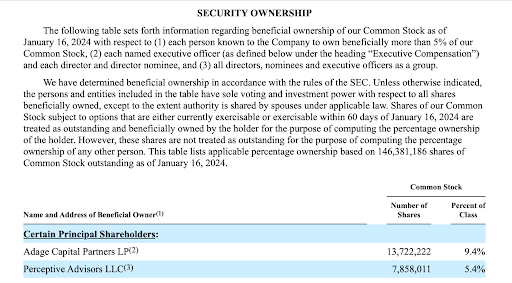

The company should have sufficient capital to fund itself through top-line data, having recently completed a $33mm public offering at $0.72, which, based on a 13G filing, appears to have been led by the huge Boston-based hedge fund Adage Capital, and also noted smart money fund, Perceptive Advisors. The stock currently trades at $0.43, giving it a very affordable $60mm market cap.

Why Veru Will Not Work as a Trade

Despite reputable funds like Adage and Perceptive stepping up on Veru’s latest financing, the early evidence is that investors aren’t buying Veru’s pivot into obesity. The stock has drifted substantially from the deal price, and the company’s attempts to engage investors with “news,” like an IND filing, seem to fall flat. Although we see the appeal of the weight loss narrative Veru is trying to sell to investors, the story has holes. Enobosarm’s legacy muscle preservation data are mixed at best (if you haven’t read the link to the Adam Feuerstein article above, go back and do so). We have also heard some questions about the safety of SARMs as chronic therapy alongside GLP-1s. As noted, the company, it’s CEO, and the drug all have colorful histories.

Veru’s financial health has improved after the $33mm financing in December, but it is far from ideal. The company was on fumes before the December financing ($9mm in treasury as of 09/30), and, as of its last quarterly report, it had been tapping its stock purchase agreement with Lincoln Park and its ATM with Jefferies. The company should have sufficient capital to see itself through the Phase 2 data later this year, but a finance overhang may still exist and weigh on the stock.

Final Thoughts

The more time we spent on Veru and enobosarm, the more questions and issues we found. That’s why we are presenting it as a trade idea. Investors who have stayed with us through these final sentences contemplating an “investment” in Veru should not overthink it. It is a bet on a theme, a narrative, not the probability of clinical success. Buyer beware.