Xenon Pharmaceuticals (Nasdaq: XENE)

Xenon always issues a press release heading into the JP Morgan conference outlining their plans for the year, so investors should get clarity on their depression/mood disorder plans for XEN1101 shortly. The company has surged to an all-time high, partly due to the recent CNS M&A activity and speculation about Xenon being an acquisition target. Although Xenon could undoubtedly be in play, don’t discount the possibility that Xenon actually becomes the acquirer, bringing in a development-stage asset to diversify its pipeline beyond XEN1101.

Cellectar Biosciences (Nasdaq: CLRB)

Among people we speak with, there is much optimism around the impending pivotal data release for CLR 131 in Waldenstrom’s macroglobulinemia, scheduled for the week of JP Morgan (Jan 8th). Assuming a positive outcome (read our earlier note on what defines “positive”), we’re curious to see if the stock can rip higher, even with the $3.185 warrants from their earlier tranched financing being exercised (à la Soleno), or will the stock get bogged down by the warrants (à la Delcath). Investor optimism around Cellectar is further emboldened by the recent M&A activity in the radiopharmaceutical sector, with RayzeBio (Nasdaq: RYZB) and Point Biopharma (Nasdaq: PNT) being acquired in 4Q23.

Soleno Therapeutics (Nasdaq: SLNO)

Soleno plans to submit an NDA for DCCR for the treatment of Prader-Willi Syndrome by mid-24, and even if FDA grants priority review, the timing will be tight for a PDUFA date in calendar 2024. However, it wouldn’t be surprising to see FDA call an Advisory Committee, which would almost certainly fall into calendar 2024 and be must-watch biotech theatre.

Delcath Systems (Nasdaq: DCTH)

Since the August FDA approval of HEPZATO KIT for metastatic uveal melanoma, Delcath investors have anxiously awaited the commercial launch, which should be announced imminently. We assume the company has commercial product in hand and is already scheduling its first commercial procedures and training/proctoring of new commercial sites. Once the launch is announced, investors can focus on the commercial ramp, particularly the push towards $10mm/Q revenue, which triggers the final $25mm tranche of their pre-PDUFA financing and visibility towards cash-flow breakeven. We remain optimistic that Delcath can “thread the commercial needle” we highlighted in our earlier note and achieve the $10mm/Q goal by 3Q24.

Fennec Pharmaceuticals (Nasdaq: FENC)

Three things to watch from Fennec in 2024: reaching cash-flow break-even (could happen as early as 4Q23), a decision on their European commercial direction, and early indications of traction in the adolescent and young adult population (AYA). Some investors have suggested that Fennec is not really interested in building out its commercial efforts in the AYA population; instead, they are using it to increase their total addressable market to attract a higher bid from potential acquirers. Fennec had implemented an incentive plan in early 2023 that provided a healthy bonus to management if an acquisition was consummated during the year. It will be interesting to see if they implement another such plan this year.

Nektar Therapeutics (Nasdaq: NKTR)

Nektar is a curious story. It trades at a substantial discount to its cash balance, has two Phase 2 studies ongoing with its lead asset REZPEG, and litigation against Eli Lilly where the company appears (based on our non-legal opinion) to be well positioned. But, the studies don’t readout until 2025, and the company has given no timelines on the Lilly litigation, so without visibility to a near-term catalyst, do investors (other than RA Capital, who bought 10% of the company a few months ago….) even care at this stage?

NLS Pharmaceuticals (Nasdaq: NLSP)

In keeping with their confusing communication strategy, in November NLS announced it had signed a non-binding term sheet with a “strategic partner” to out-license its intellectual property, including its Phase 3 ready narcolepsy asset Mazindol ER. Then, two weeks later, the company announced it had signed an option agreement to in-license a portfolio of early-stage sleep drugs to “complement and strengthen” its existing sleep franchise. Huh?

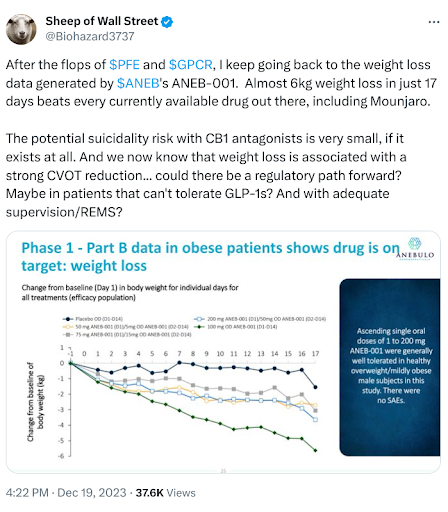

Anebulo Pharmaceuticals (Nasdaq: ANEB)

Anebulo is ramping up to start a pivotal program for ANEB-001 in acute cannabinoid intoxication in 2024. Still, the balance sheet likely needs to be addressed before starting either of the two planned Phase 3 studies. In the meantime, we found this tweet from one of the company’s largest shareholders interesting.

Gain Therapeutics (Nasdaq: GANX)

Gain has been making good progress on their Phase 1 study with GT-02287 and should report their first-in-man safety data from the single-ascending dose in 1Q24. By mid-24, the company should be able to report additional safety data from the multiple-ascending dose cohort and preliminary data on GCase activity before transitioning to a Parkinson’s disease (Phase 1b) cohort in 2H24. Gain added $10mm of much-needed incremental capital in 4Q23, which should bridge them through their Phase 1 study. As we highlighted in an earlier note, GT-02287 is a very interesting asset, and if early-stage companies with good science start catching a bid in this tape, Gain is a name to watch.

Satellos Biosciences (TSX-V: MSCL, US: MSCLF)

Satellos has guided that it should be in the clinic with SAT-3247 mid-24. With its unique muscle regeneration approach to the treatment of Duchenne muscular dystrophy (DMD), the company may benefit from the regulatory drama that could unfold for DMD pioneer Sarepta Therapeutics in 2024, which should keep DMD top-of-mind for investors.