Structure Matters

Investors ignore structure at their peril. In previous notes, we have highlighted how finance structures limited the impact of positive news for companies who entered into tranched financings, like Delcath Systems (Nasdaq: DCTH) and Cellectar Biosciences (Nasdaq: CLRB). Then, our last note was focused on Optinose (Nasdaq: OPTN), its impending PDUFA date, and how its financial structure could weigh on the stock. We wrote, “Although we gravitate towards FDA approving XHANCE for CRS (chronic rhinosinusitis), we feel that the upside for Optinose off a PDUFA approval, at least in the near term, is muddied by its financial situation.”

As we expected, FDA approved XHANCE on March 16th, making it the first and only product approved for CRS. This was an incredibly positive development for OptiNose, increasing the addressable market for XHANCE by 10x, according to the company. However, the equity hasn’t responded due, in our opinion, to a combination of debt concerns, finance overhang, and anti-dilutive warrants. The equity will likely remain stuck until most or all of these financial issues are addressed.

We Aren’t the Only Ones…

A few notes back, we celebrated the return of Nav1.7 for pain to the Xenon Pharmaceuticals (Nasdaq: XENE) pipeline chart. It was encouraging to learn that we aren’t alone in our curiosity about this program, with no less than five analysts asking about Nav1.7 on the company’s recent earnings call. Although the company didn’t have much new information to share, given the early stage of this program, it is clear that the street is interested, likely due largely to the enormous value Vertex Pharmaceuticals (Nasdaq: VRTX) has created from their Nav1.8 pain program.

Nav1.7 may have captured the sell-side’s (and our) attention, but will discovery and preclinical data fill the clinical data vacuum facing Xenon? The company’s next significant data readout will likely be in late 2025, from the first of its XEN1101 Phase 3 epilepsy studies. We continue to speculate that Xenon, with its bulging treasury, may look to add to the “middle” of its pipeline chart through M&A.

Curious Bet Finally Paying Off?

In January, we wrote about how notable smart money funds Adage Capital and Perceptive Advisors had made a curious obesity bet on VERU Inc. (Nasdaq: VERU). Both funds participated in the company’s $0.72 public offering in December 2023. Since the deal was priced, the stock has traded below the offering price, at times substantially, until this week, when it popped above $0.72 for the first time. Maybe it was the Raymond James initiation late last week with a $3 price target or investor anticipation over the imminent initiation of the company’s Phase 2 enobosarm obesity study. Regardless, investors may want to keep an eye on Veru to see if it can sustain its push through the $0.72 offering price. The stock could work well if it can, given investor infatuation with the obesity theme and the timing of top-line data guided before year-end. However, here is a reminder of what we wrote back in January when discussing Veru as a speculative idea: “It is a bet on a theme, a narrative, not the probability of clinical success. Buyer beware.”

Radiopharmaceuticals Remain Hot

Add Fusion Pharmaceuticals (Nasdaq: FUSN) to the growing list of recent radiopharmaceutical acquisitions after it was snapped up by Astra Zeneca (NYSE: AZN) for $2.4b last month. Fusion becomes the third notable acquisition in the space, following Bristol Myers’ (NYSE: BMS) $4b acquisition of RayzeBio (Nasdaq: RYZB) and Eli Lilly’s (NYSE: LLY) $1.4b acquisition of Point Biopharma (Nasdaq: PNT) both in late 2023. All this M&A activity certainly fuels speculation about other radiopharmaceutical companies being acquisition targets. Looking at you Cellectar…..

The Wheels of Justice Turn Slowly? A Flurry of Activity in Nektar v Lilly

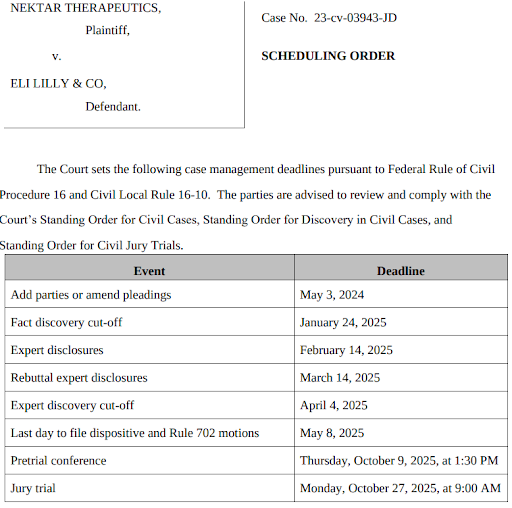

In our last note, we highlighted that Nektar Therapeutics (Nasdaq: NKTR) case for breach of contract and negligent misrepresentation against Eli Lilly (NYSE: LLY) for their alleged mishandling of REZPEG data was moving ahead. Early in March, the court refused Lilly’s request for dismissal and ordered the companies to enter mediation. Then, at the end of the month, the court set dates for all the pretrial events leading up to an October 27, 2025, jury trial.

Investors are unlikely to hear much more from the court about the case this year. Nonetheless, the court-ordered mediation process and the firm date for the trial, in our opinion, increase the possibility of a settlement over the next 18 months.

Optimism > Caution

At times, we have been slightly critical of Delcath’s messaging around the commercialization of Hepzato. The company’s CEO, Gerard Michel, is very thorough and transparent, which, in our opinion, sometimes comes across as cautious and makes the sales process for Hepzato sound overly complicated. In the micro/small cap universe, where most CEOs are promotional and downplay risk, Gerard is unique for his transparency about the company’s risks and challenges.

Last week, on the company’s FY2024 call, Gerard was his usual thorough and transparent self, but the tone felt different, in our opinion, more optimistic than cautious. It’s early innings for the Hepzato launch, but there are some encouraging trends. Just over three months post-launch, the company already has 9 sites actively accepting patient referrals. As of this week, a Hepzato-specific J-code from CMS came into effect, simplifying the reimbursement process. By the end of the year, the company expects to have 20 sites active (up from their original guidance of 15), and each site to be doing two procedures a month. Based on these figures, our back-of-the-envelope math has Hepzato revenue of around $15mm for 4Q2024.

Gerard is not prone to hyperbole, so we suspect he has high confidence in the guidance provided on the FY2024 call. Investors should still temper their Hepzato revenue expectations for 1Q2024, but beyond that, it wouldn’t surprise us to see the company start overachieving expectations.

Another Name from the Past

In September 2021, we wrote an extensive note on NervGen Pharma (TSXV: NGEN, US: NGENF), stating, “NervGen is not an investment for the faint of heart, but for those investors who like to bet on trailblazing biotech companies with truly novel, disease-modifying, science, and moonshot potential, then NervGen at a ~$70mm market cap should have plenty of appeal.” That note may be dated; many things have changed since it was penned, yet the moonshot potential we refer to is very much intact and imminent, as is the risk we refer to when describing it as an investment, not for the faint of heart.

Investors interested in the science behind NVG-291 can read our earlier note, but for quick reference, NVG-291 is a daily injectable peptide that is believed to promote nerve repair and growth. The company was founded based on NVG-291’s potential to treat spinal cord injury (SCI). The company contemplated pursuing Alzheimer’s Disease as its lead indication (see our earlier note) before returning to its roots and pursuing SCI for its first human efficacy study. The company still believes NVG-291 has potential in Alzheimer’s, as well as other neurodegenerative diseases. However, SCI as a lead indication has some distinct advantages, including; it is the indication where the company has generated the most preclinical evidence for NVG-291, it is the quickest and most affordable path to human proof-of-concept data, and, given the lack of approved therapies for SCI, the efficacy bar (and maybe regulatory bar) is arguably quite low.

NervGen completed Phase 1 with NVG-291 in 2023 and began actively enrolling a Phase 2a SCI late last year. This Phase 2a randomized controlled study has two treatment cohorts: a chronic SCI cohort for patients 1-10 years post-injury and an acute SCI cohort for patients 10-49 days post-injury. Although these two cohorts fall under the same protocol, they are, in essence, two separate 20-patient studies (10 NVG-291 / 10 placebo in each cohort). Currently, the company is only enrolling patients in the chronic SCI cohort and has guided top-line data should be available in 3Q2024.

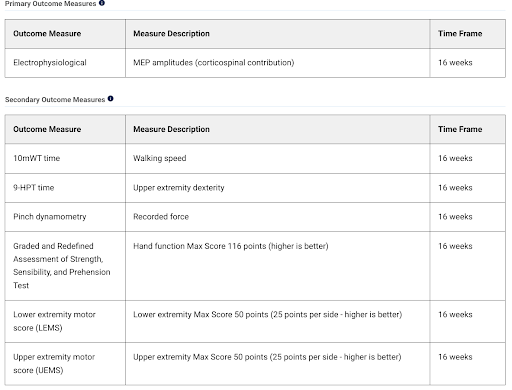

This is a proof-of-concept study; accordingly, the company will collect data across a plethora of endpoints. The study’s primary endpoint is electrophysiology, measuring motor evoked potentials (MEPs) after neurological stimulation. Secondary endpoints are predominantly functional, including upper and lower body performance tests. There are also a number of pre-defined exploratory endpoints, including bladder function, quality of life, and certain biomarkers.

For investors, proof-of-concept studies in underserved indications, such as SCI, offer multiple ways to win. Remember a few years ago when Alzheimer’s companies’ valuations soared off Phase 1b biomarker data? NervGen has designed a data-rich study, including surrogate and functional endpoints that, assuming NVG-291 is active, provide multiple opportunities for the company to see an efficacy “signal”.

If NVG-291 can show a benefit in MEPs vs placebo, that would be an encouraging signal for the company. In this scenario, the company should have the evidence to raise meaningful capital and advance the program into later-stage studies. Things could get really interesting if NVG-291 shows functional benefits as well. This is the moonshot scenario we referred to earlier. If the surrogate MEP endpoints correlate with functional benefit, then NervGen probably has a drug. It may be a stretch, but in this scenario, could there be a rationale for a conversation with FDA about accelerated approval?

The other extreme is that NVG-291 shows little to no benefit in this proof-of-concept study. In this scenario, NervGen, as a single-asset company, has a very uncertain future. The company recently raised CA$23mm to fund the acute cohort of the Phase 2a study, but investors are unlikely to be supportive after a clinical setback in the chronic cohort.

When we first wrote about NervGen, we said it was not an investment for the faint of heart. Years later, as we finally approach the company’s first big data reveal, we stand by that assertion. There are limitless combinations and permutations of outcomes from a proof-of-concept study such as NervGen’s. However, investors considering owning NervGen through the Phase 2a data event in Q3 should ensure they have the stomach for the “hero or zero” extremes.