In a September 2023 note, we highlighted Nektar Therapeutics (Nasdaq: NKTR) as an interesting negative EV name investors should have on their radars. Although the stock has appreciated nicely since our note, at an approximate $190mm market cap today, it still trades well under its treasury balance, which we estimate to be around $325mm. With such a plump treasury, we found it curious to see Nektar raise another $25mm (our estimated $325mm treasury balance includes this raise) in a private placement last week, even if it came from a good fund and at a healthy premium to the market.

Nektar knows how to spend money. The company’s last three fiscal year-end cash balances were $798mm (2021), $505mm (2022), and then $329mm (2023). The company disclosed that it had a cash runway into 3Q26 after this recent financing, giving it a little more than 2 years of cash. This is important because although the company trades at a discount to cash today, by the time the company approaches its next meaningful data catalyst in 1H25 (REZPEG Phase 2 atopic dermatitis data), it will likely have chewed through half its treasury and be approaching 1-year of cash runway. Delivering critical data on the backdrop of a treasury between $150mm and $200mm would be a luxury for most small-cap companies, but is it for Nektar? Remember, this was once an $18b market cap company. It’s hard for one-time high-flying companies like Nektar to recalibrate their behaviors (spending) to their new reality. So, when we saw the recent $25mm financing, it made us question how comfortable the company will be with its cash balance heading into REZPEG data in 1H25.

While questioning Nektar’s spending habits and casualness around dilution, we remain intrigued by the combination of their cash balance, REZPEG’s Phase 2 development, and the ongoing Eli Lilly (NYSE: LLY) litigation. Regarding the latter, on the company’s recent FY2023 call, when asked about the Lilly litigation, CEO Howard Rubin responded, “…last week, the federal judge refused Lilly’s request (for dismissal), and the judge agreed to allow Nektar’s primary claims to move forward. We expect the judge to set a trial date in 2025. The court also ordered the parties to engage in mediation within the next 3 months to try to resolve the issue. And so, we’re very, very happy the case is moving forward.” The possibility of a near-term settlement from the mediation process is encouraging and would be a welcome source of non-dilutive capital, in our opinion.

Speaking of “Plump” Balance Sheets

In our last note, we briefly discussed the speculation around Ventyx Biosciences (Nasdaq: VTYX) and a pivot into obesity with their CNS-penetrant NLRP3 asset. All signs pointed to an obesity coming-out party at their March 11th virtual investor event, and on-script, the company used this platform to announce its plan to pursue obesity formally.

The week prior, the company topped up its already healthy balance sheet ($250mm as of YE2023) with another $100mm through a private placement with a good group of funds.

And the Not-So “Plump”

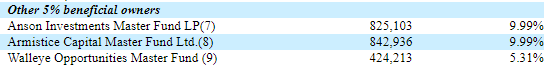

Also trafficking in the NLRP3 space is Zyvera Therapeutics (Nasdaq: ZVSA). They have an antibody in preclinical development that targets multiple inflammasomes, including NLRP3. However, unlike Ventyx, Zyversa’s balance sheet is not in good health, so it wouldn’t be surprising to see a financing announced soon to fund a push into obesity. Investors should be forewarned that the company seems to attract “colorful” shareholders, which could complicate the structure of a deal.

Sticking with the Finance and Obesity Theme

At the end of our last note, we acknowledged an error after mistakenly including Perceptive Advisors as a participant in Skye Bioscience’s (OTC: SKYE) $50mm late-January PIPE. Perhaps our mistake was, in fact, foreshadowing, with Perceptive leading a $40mm PIPE this week. Skye impressively has raised $90mm over a short period of time, first at $2.305/share and then recently at $10/share, to fund its CB1 obesity program.

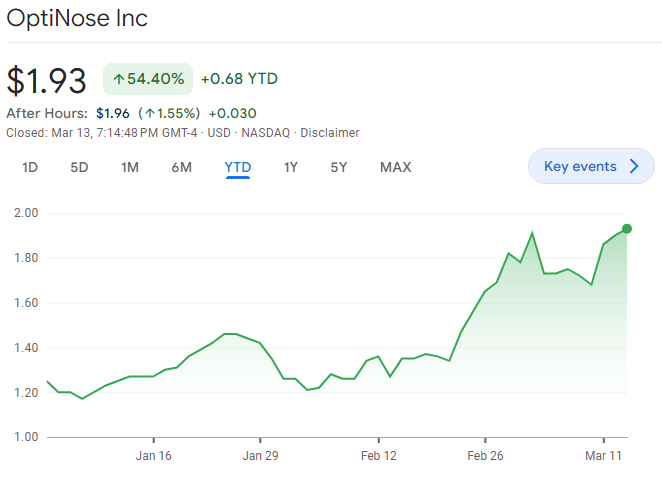

Optinose Trending Higher Into PDUFA

Biotech investors casually throw around the term binary, but it seems like an appropriate way to describe Optinose (Nasdaq: OPTN) and its impending March 16th PDUFA date. FDA is currently reviewing Optinose’s sNDA for XHANCE, the company’s fluticasone-based drug-device combination, for the treatment of chronic rhinosinusitis (CRS). If approved, XHANCE would be the first product approved by FDA for the CRS indication. What makes FDA’s decision so binary for Optinose is the company’s wall of debt ($130mm), with near-term (March 31) covenants that it will likely break, putting it at risk of default. An approval should keep Optinose’s lenders at bay, allowing the company to reap the rewards of XHANCE becoming the first product approved by FDA for CRS. An FDA rejection, a complete response letter (CRL) for any reason, puts the company’s viability in its lender’s (Pharmakon) hands.

Addition By Subtraction

FDA approved XHANCE in late 2017 for the treatment of CRS with nasal polyps. XHANCE uses the same active ingredient, fluticasone, as GSK’s popular asthma and allergy drugs, Flovent and Flonase, respectively. What differentiates XHANCE is its exhalation delivery system, which allows greater penetration of fluticasone into the nasal cavity and sinus. Optinose experienced a healthy sales ramp after its 2018 launch, but sales have plateaued in the $70mm range over the last few years, and the company remains unprofitable.

The challenge commercially is the polyp diagnosis, which often requires a nasal endoscope, an instrument used almost exclusively by ear, nose, and throat (ENT) specialists. If XHANCE were approved for CRS, it would be addition by subtraction for Optinose. By eliminating the need for the polyp diagnosis, the company estimates that XHANCE’s addressable market would increase 10x. That’s the big opportunity for Optinose – for XHANCE to become the first FDA-approved product for CRS, a market with far more patients and prescribers (allergists and primary care physicians) than nasal polyps. The scale of what is estimated to be a multi-billion dollar CRS market could be beyond Optinose’s capabilities, and the company has openly discussed the potential for partnerships to help tackle this opportunity.

High Stakes PDUFA Drama

Optinose ran two successful Phase 3 studies, ReOpen1 and ReOpen2, in CRS. The company submitted its sNDA in February 2023 and received a December 16th PDUFA date. According to the company, in November FDA requested “additional efficacy subset analyses of existing clinical data from one of the two trials submitted in the sNDA: ReOpen1.” Shortly after, FDA pushed the PDUFA date to March 16th in order to complete its review of the new data.

As investors, we try to interpret FDA’s intent, to read its body language, around these types of extensions. From our perspective, an extended review based on efficacy, assuming Optinose is transparent about FDA’s request, would make a CRL for safety very unlikely. However, the probability of safety triggering a CRL was already low, given that XHANCE already has FDA approval for nasal polyps and a large safety database. Furthermore, if FDA had substantial issues with efficacy, they likely would have CRL’d XHANCE rather than extend the PDUFA. In our opinion, the extension, although painful from a financial perspective (more on this below), can probably be viewed as slightly encouraging for the probability of XHANCE’s approval. But what exactly is FDA looking for in their subanalysis request?

ReOpen1 enrolled CRS patients with and without polyps, whereas ReOpen2 only enrolled CRS patients without polyps. Both studies had co-primary endpoints of a patient-reported composite of nasal congestion, nasal discharge, and facial pain (CSS) and a CT scan measure of sinus inflammation referred to as APOV. In both studies, XHANCE met the co-primary endpoints in CSS and APOV. There is a mention of certain subgroup analyses performed in ReOpen1 in Optinose’s FY2023 10-K:

-

- Although ReOpen1 was not designed or powered to detect statistical differences between the XHANCE treatment groups and placebo EDS in patient subgroups, we also performed the following subgroup analyses:

- Subgroup Analysis – CSS. The subgroup of chronic sinusitis patients without nasal polyps receiving XHANCE and the subgroup of chronic sinusitis patients with concomitant nasal polyps receiving XHANCE had statistically significant reductions in CSS scores relative to the subjects receiving placebo EDS in each of these subgroups despite the lack of powering for this subgroup analysis.

- Subgroup Analysis – APOV. The subgroup of chronic sinusitis patients with concomitant nasal polyps receiving XHANCE achieved a statistically significant reduction in APOV relative to the subjects receiving placebo EDS in this subgroup despite the lack of powering for this subgroup analysis. The subgroup of chronic sinusitis patients without nasal polyps receiving XHANCE did not achieve a statistically significant change in APOV relative to the subjects receiving placebo EDS in this subgroup.

- Although ReOpen1 was not designed or powered to detect statistical differences between the XHANCE treatment groups and placebo EDS in patient subgroups, we also performed the following subgroup analyses:

Could FDA be hung up on the second bullet, that the subgroup of CRS patients without nasal polyps in ReOpen1 didn’t have statistically better improvements in APOV than placebo? It would be strange if that were the case, given that ReOpen2, which enrolled only patients without nasal polyps and had a larger sample size, demonstrated a statistically significant improvement in APOV for XHANCE vs. placebo. There could be other subgroup analyses beyond those shared by Optinose that FDA is digging into (exacerbations?). Regardless, in our opinion, based on the data publicly available, there doesn’t appear to be any glaring issues with XHANCE’s efficacy from either CRS study.

There’s always drama around a PDUFA date, but the three-month extension amplified the drama around Optinose’s XHANCE PDUFA. There are several covenants attached to their $130mm debt obligation to Pharmakon, including going concern, revenue, and balance sheet obligations. If FDA had approved XHANCE on its original PDUFA date in December, Optinose would likely have been able to navigate all its covenant obligations. The three-month PDUFA push meant Optinose had to obtain a going concern waiver from Pharmakon covering the Company’s financial statements for the periods ending December 31, 2023, and March 31, 2024. Optinose also has a March 30th trailing 12-month revenue covenant ($82.5mm), which the company disclosed in its FY2023 10-K is “probable” to be missed, but we feel it is “assured” to be missed. The stakes were already high for Optinose heading into its original December PDUFA, but they are even more acute now heading into this week’s FDA decision.

Binary Outcome Assured

Although it is certainly unaware (and indifferent), on March 16th, when FDA decides XHANCE’s future as a treatment for CRS, it will also be deciding the fate of Optinose. If FDA does not approve XHANCE, Optinose will likely find itself unable to raise capital and default on its debt covenants. Pharmakon will be in control, and equity holders will be wiped out. That’s the doomsday outcome, but among the investors we speak with, there is a high confidence in an FDA approval.

An FDA approval doesn’t immediately solve Optinose’s financial problems, but our assumption is that equity and/or debt options will be readily available and that Pharmakon will be accommodating regarding upcoming debt covenants. Although we are confident in the company’s financial viability after an FDA approval, it is difficult to predict how much upside there is for the stock for those wanting to play the PDUFA. Although the company has a decent cash balance ($77mm as of 12/31/2024), we assume the company will want to raise additional capital to fund a big push for XHANCE into CRS. Besides a perceived financing overhang, the stock’s immediate post-PDUFA upside may be limited by the 30mm warrants outstanding ($2.565 strike) that have anti-dilution protection. Those warrants are from a 2022 $1.89 financing, so any participants from that deal who still hold a position would arguably have an incentive to sell, given that they still have a warrant that will be re-priced at any deal below $2.565.

Although we gravitate towards FDA approving XHANCE for CRS, we feel that the upside for Optinose off a PDUFA approval, at least in the near term, is muddied by its financial situation. However, we feel the downside of an FDA rejection is catastrophically clear. Investors with a stomach for risk can choose to play the Optinose PDUFA date, long or short, but grabbing some popcorn and watching the drama unfold from the sidelines makes the most sense to us.