Over our last few notes, we have thrown around some micro/small cap names that could benefit from the ongoing investor infatuation around development-stage obesity assets. So, in keeping with that theme, we have another small company, $40mm market cap Entera Bio (Nasdaq: ENTX), that quietly stuck its toe in the obesity pool last year yet remains undiscovered by investors today.

Oral GLP-1s: A Forgotten Player

Before discussing Entera, we want to spend a few sentences on a company whose role in the development of one of today’s most popular diabetes and obesity drugs is mainly forgotten. A company whose past might hint at the path and the promise for Entera. In 2008, Emisphere Technologies (formerly Nasdaq: EMIS) entered into a collaboration with diabetes, and now obesity, giant Novo Nordisk (NYSE: NVO) for the development of an oral Glucagon-like peptide-1 (GLP-1) agonist. Emisphere had a drug formulation technology called Eligen SNAC, an absorption enhancer that had shown promise in the oral delivery of peptides. Novo wanted to use Eligen SNAC to formulate an oral version of their development-stage GLP-1 peptide semaglutide for the management of diabetes. In 2019, the Emisphere/Novo collaboration bore fruit when FDA approved Novo’s GLP-1 agonist Rybelsus, the first, and to this day, only FDA-approved oral peptide. In 2020, Novo purchased Emisphere for $1.8b. For FY2023, Novo reported Rybelsus sales of $2.7b and year-over-year growth of 66%. Novo has recently reported successful Phase 3 studies in diabetes and obesity using higher doses of oral semaglutide, which almost certainly uses Emisphere’s technology. These Phase 3 successes with higher doses of oral semaglutide pave a path that could see Novo’s oral GLP-1 franchise eventually become more valuable than their $18b (FY2023) injectable GLP-1 franchise (Ozempic and Wegovy). Any wonder why they acquired Emisphere?

Entera: Rybelsus Redux? Emisphere 2.0?

Peptides are a mainstay of medical treatment today, but because of their poor bioavailability, they are almost exclusively delivered via injection. The Emisphere story demonstrates the value of a platform that enables the oral delivery of peptides. Entera has an oral delivery technology, N-Tab, similar to Emisphere’s Eligen SNAC but with enhanced absorption and stabilizing features. Entera has validated the N-Tab platform with its development of an oral parathyroid hormone (PTH) that has been studied in numerous clinical trials, including successful Phase 2 studies in osteoporosis and hypoparathyroidism. In a future note, we will likely discuss these programs, which remain active and have big potential catalysts in 2024. Today, we want to focus on the company’s earlier stage pipeline, specifically an oral dual-acting GLP-1/Glucagon agonist for obesity.

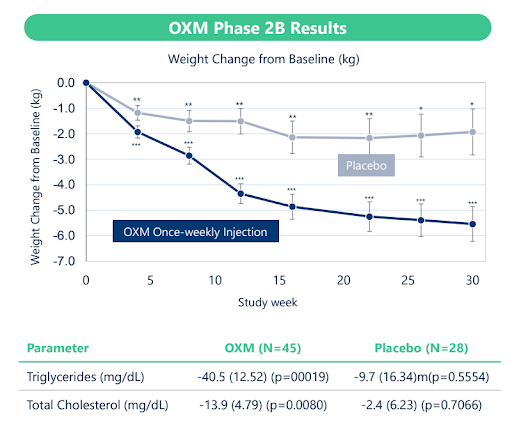

In September 2023, Entera announced a collaboration with OPKO Health (Nasdaq: OPK) for the development of two oral peptide formulations, one a GLP-2 peptide for short-bowel syndrome (another program we may discuss in a future note) and the other, an analog of Oxyntomodulin (OXM), a dual-acting GLP-1/Glucagon agonist for obesity. OXM is a naturally occurring peptide found in the intestine. Eli Lilly (NYSE: LLY) developed an analog of OXM that OPKO eventually acquired. OPKO ran several studies with this injectable OXM analog, including a Phase 2b study demonstrating meaningful weight loss and lipid-lowering benefits.

Two is Better Than One: Dual-Acting GLP-1/Glucagon Agonism

The dual-acting GLP-1/Glucagon agonist approach to weight loss and metabolic disease has been topical this week, with Boehringer Ingelheim (BI) and Zealand Pharma (Nasdaq Copenhagen: ZEAL.CO) announcing positive data for their dual-acting peptide survodutide from a Phase 2 MASH study. MASH (metabolic dysfunction-associated steatohepatitis) is a common liver disease often associated with obesity. It is believed that with a dual-acting GLP-1/Glucagon agonist like survodutide (and OXM), the liver benefit derives predominantly from targeting Glucagon, whereas the weight loss derives predominantly from targeting GLP-1. Regardless, investors liked the data and rewarded Zealand by chasing the stock 35% higher on the day of the news.

BI and Zealand are not the only companies pursuing the dual-acting GLP-1/Glucagon agonist approach. Altimmune (Nasdaq: ALT) and Lilly have dual-acting GLP-1/Glucagon agonists in mid/late-stage clinical programs for obesity (and MASH for Altimmune). It is worth re-emphasizing that none of these dual-acting GLP-1/Glucagon agonist programs are oral; they are all injectables.

Entera/OPKO: Details Light, Curiosity High

The Entera/OPKO collaboration is focused on using Entera’s N-Tab technology to formulate new, oral, dual-acting OXM analogs developed by OPKO. At their recent Oppenheimer presentation, the CEO of Entera, Mirana Toledano, stated that the companies should have preclinical data for this program by mid-24. On the OPKO Q3 and Q4 earnings calls, the company’s CEO, Phil Frost, made a point of discussing the development of new OXM analogs and the Entera collaboration in his prepared remarks. He discussed how the new OXM analogs are unique from the previous generation, with lower molecular size, which should allow them to push the dose, which should improve weight loss. In the Q&A of both calls, the Jefferies analyst tried to tease more details out of CEO Frost about their OXM plans, but he was reluctant to share more information at this early stage. Nevertheless, it is comforting to know that others are as curious about this program as we are.

Investors Making Speculative Obesity Leaps

So why highlight a collaboration for an early-stage, nascent program with minimal information that sits at the bottom of Entera’s pipeline chart and has yet to appear on the OPKO chart? Because investors are looking for small, undiscovered obesity plays. Look no further than the activity in Ventyx Biosciences (Nasdaq: VTYX) and ZyVersa Therapeutics (Nasdaq: ZVSA) as evidence of investors’ willingness to chase the obesity theme. Both stocks surged off preclinical weight loss data generated by a private company, NodThera, with a drug in the same class, NLRP3 inhibitors or inflammasomes, as Ventyx and ZyVersa. Yet, if you listen to Ventyx’s Oppenheimer presentation earlier this month, there is no discussion about the company pursuing obesity with its NLRP3 product. In fact, obesity doesn’t even show up in either company’s pipeline chart. Regardless, investors have been gladly making the speculative leap that one or both of these companies may make a pivot into obesity based on 3rd party preclinical data.

That leads us back to Entera with its modest $40mm market cap and how its obesity angle, in our opinion, has yet to be appreciated by investors. Granted, Entera’s obesity program is early, but oral delivery of peptides, and specifically GLP-1, is a VERY big deal. Emisphere and Novo proved it could be done, and Rybelsus is a huge success. Entera has proven, with its more advanced programs in osteoporosis and hypoparathyroidism, that it can create oral formulations of peptides and generate meaningful human proof of concept data. OPKO has proven that its earlier analog of OXM generated meaningful weight loss in patients and hinted that its new OXM analogs may be more efficacious. Lilly, Altimmune, and BI/Zealand all have dual-acting GLP-1/Glucagon agonists in mid/late-stage development, validating this as an attractive target. Investors chasing the next hot obesity play are willingly taking speculative leaps into small speculative companies. In our opinion, the leap into Entera as an early-stage obesity play isn’t that speculative.

Correction From an Earlier Note

In a note we published a few weeks ago, we discussed a $50mm private placement in Skye Biosciences (OTC: SKYE) led by Baker Bros. We wrote that Perceptive Advisors also participated in the deal, but after reviewing the company’s filings, we realized that Perceptive, in fact, had not participated. The deal did include other notable life science investors besides Baker Bros, including 5AM Ventures, Sphera, and Ally Bridge, but we wanted to acknowledge our mistake around Perceptive’s involvement.