Bones and Bladders

In our initial note on Entera Bio (Nasdaq: ENTX), we turned their pipeline chart upside down by focusing on their earliest stage program, an oral dual-acting GLP-1/Glucagon agonist for obesity. As investors await for Entera to share their first data from the obesity program, the company reported some encouraging developments for its late-stage osteoporosis program. So, we figured it would be time to turn the company’s pipeline chart in the proper direction and invest a few sentences in its most advanced asset, EB613, for osteoporosis. But first, a quick preamble on osteoporosis.

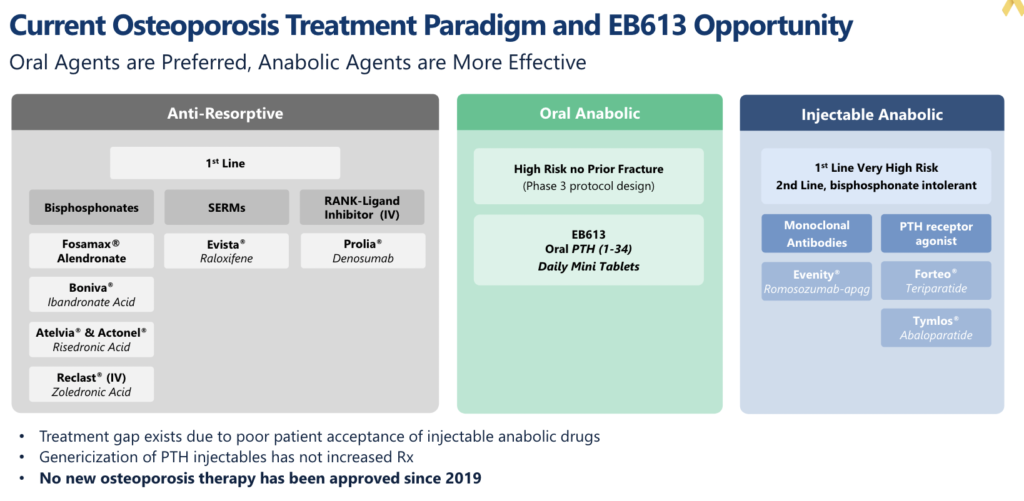

Osteoporosis is an enormous market, estimated to afflict 200 million women globally. Yet, for an indication of such size, it is surprisingly absent from the pipeline charts of most big biopharma companies. The absence of biopharma participation has caused a dearth of innovation despite a clear medical need, especially in the high fracture-risk population. A quick search of the clinicaltrial.gov website for mid- to late-stage osteoporosis studies is littered with generics and biosimilar programs, but there are virtually no new drug programs. One of the main explanations for this lack of innovation in osteoporosis is FDA’s requirement for fracture reduction as a primary endpoint for registrational trials, demanding large, long, and expensive studies. Many argue that an approvable surrogate endpoint for fracture is needed, much like what FDA accepts for lipid-lowering or blood pressure medicines.

Over ten years ago, a project was initiated by the Foundation for the National Institutes of Health (FNIH) to assemble data from >170,000 patients across >50 osteoporosis studies to assess the correlation between bone mineral density (BMD) and fracture risk. Starting in 2018, the data from what became known as the SABRE (Study to Advance BMD as a Regulatory Endpoint) project was published and presented in high-profile scientific journals and symposia. Here is a statement from the 2022 Lancet Diabetes and Endocrinology publication on SABRE “Treatment-related BMD changes are strongly associated with fracture reductions across randomised trials of osteoporosis therapies with differing mechanisms of action. These analyses support BMD as a surrogate outcome for fracture outcomes in future randomised trials of new osteoporosis therapies…” There’s not a lot of ambiguity in that statement.

In 2022 FDA agreed to review a qualification plan based on the SABRE project to use BMD as a surrogate endpoint for future osteoporosis drug approvals. The full qualification plan was submitted in late 2023, and last month FDA communicated that it would make a ruling on BMD as an approvable endpoint within ten months, which means a decision by late this year or early next year (see here).

It is important to emphasize that FDA has been involved in the SABRE project since its inception in 2013. This is language from FNIH: “The ongoing project includes partners from NIH, FDA, industry, and academia and has compiled a unique database from >50 randomized trials of osteoporosis medications, containing data on >150,000 individual patients…”

Does FDA allow a project of this size and scale, where it has some degree of involvement, to proceed for over 10 years, providing official guidance on a decision timeline, only to reject BMD as a surrogate endpoint?

Ready to Hit the Ground Running

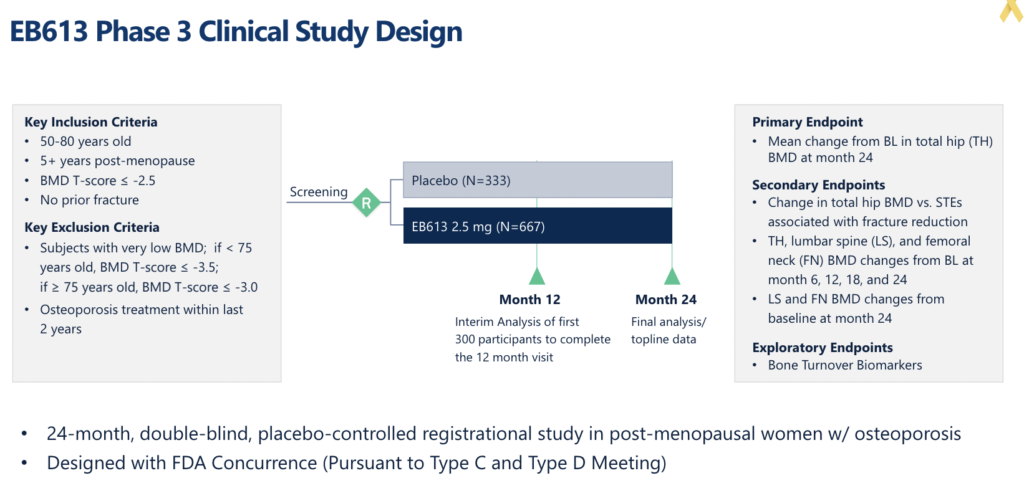

If FDA qualifies BMD later this year / early next year, the first company to run a registrational study will almost certainly be Entera with EB613, its oral parathyroid hormone (PTH 1-34). PTH 1-34 belongs to a class of bone-building drugs known as osteoanabolics. The first osteoanabolic peptide approved by FDA for osteoporosis was Eli Lilly’s (NYSE: LLY) teriparatide (branded Forteo) in 2002. If you read our earlier note on Entera, you’ll know that almost all commercial peptides are injectable, and Forteo is no exception. Despite its inconvenient daily injectable format, Forteo achieved peak annual sales of $1.7b before recently going generic.

Osteoanabolics are a small part of the large osteoporosis prescription market. Despite evidence supporting their broader use, osteoanabolics are estimated only to represent 10% of prescriptions for osteoporosis, partly due to patient resistance towards injectables. The lion’s share of osteoporosis prescriptions are for anti-resorptives, drugs that slow bone loss but do not grow new bone. Anti-resorptives are recommended for osteoporosis patients at low to medium risk of fracture, whereas osteoanabolics are recommended for high-risk patients. Generics are now increasingly pervasive throughout the osteoporosis market, but it is a market that historically has supported multiple blockbusters, including the aforementioned Forteo and currently Amgen’s (Nasdaq: AMGN) anti-resorptive antibody Prolia, which sold $4b last year.

Entera announced positive Phase 2 results for EB613 in 2021. This placebo-controlled study showed that EB613 2.5mg taken orally once daily had a statistically significant improvement in P1NP, the key biomarker for bone formation, and CTX, the key biomarker for bone resorption. This dual mechanism of action, potentially promoting bone growth and slowing existing bone loss, could be a huge source of differentiation for EB613. Importantly, EB613 2.5mg also showed statistically significant improvements in BMD versus placebo. The study was recently published in the Journal of Bone and Mineral Research, where the authors concluded, “In contrast to subcutaneous PTH, the oral PTH tablet appears to increase BMD rapidly by the dual mechanism of stimulating formation and inhibiting bone resorption.”

When these data were released in 2021, the stock soared to an all-time high. However, shortly thereafter, the regulatory reality that FDA still had not qualified BMD as an approvable surrogate endpoint curbed investor enthusiasm. Entera had several meetings with FDA after the Phase 2 data and stated that it has alignment with the Agency on a single Phase 3 registrational study design using BMD as the primary endpoint.

Entera finds itself in a precarious position. They have a Phase 3 plan with FDA’s blessing, but the Agency hasn’t officially opined on the qualification of the BMD endpoint. The company could start the study, but they would be doing so at risk. The company has flirted with investors on the prospect of funding an at-risk Phase 3 study, but the consensus from both sides was it would be better to wait for FDA’s qualification decision.

The recent FDA guidance on the timing of a qualification decision has renewed investor enthusiasm for the company’s osteoporosis program. Among the investors we speak with, there is a strong belief that FDA will qualify the BMD endpoint, positioning Entera to be the first company to run a registration program for osteoporosis with this endpoint. Investors aren’t likely to hear much additional news on EB613 and the osteoporosis program before the FDA decision. Fortunately, Entera will continue to sprinkle news on their earlier-stage oral peptide programs in obesity, short bowel syndrome, and hypoparathyroidism. Some of these programs are currently more thematic to investors; however, in our opinion, the big play in Entera is around the osteoporosis program and the potential that EB613 could be the first novel drug to be approved in this indication in over five years.

Steady Sprinkle of News? More Like a Downpour.

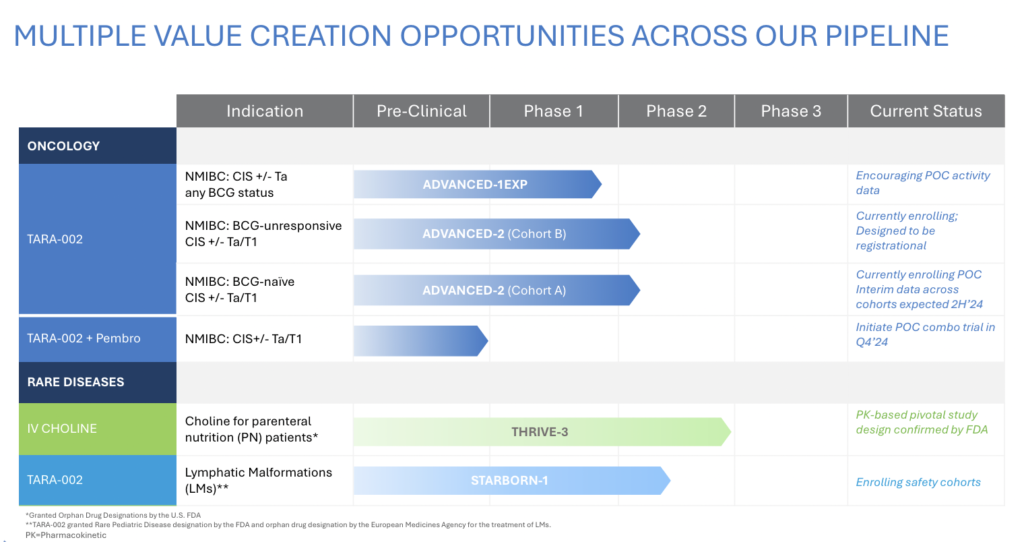

Our initial note on Protara Therapeutics (Nasdaq: TARA) in December highlighted the potential of the company, stating, “Protara doesn’t have a big data reveal in 2024, but what it should have is a steady sprinkling of data and regulatory news throughout the year, which could be appealing for investors, especially on the backdrop of a healthy balance sheet and an improving macro environment for biotech.” Contrary to our expectation of a steady sprinkle of news, the company recently had more of a downpour of news dropping three releases in a day. These announcements included preliminary non-muscle invasive bladder cancer (NMIBC) data with TARA-002, regulatory guidance from FDA for IV choline, and a $45mm private placement. Despite the initial stock spike and subsequent dip, we maintain our belief that Protara could be an attractive investment opportunity, given the cadence of clinical data over the next 6-12 months on the backdrop of an even healthier balance sheet.

Structure and Short-Term Pain

As we’ve emphasized before, deal structure matters. Protara’s $45mm private placement, priced at $4.15, included a 3-year warrant at the same price. While this structure can sometimes attract less desirable funds, it’s important to note that the financing was primarily populated with high-quality investors, including RA Capital and Baker Bros. In our opinion, the validation from these smart money funds outweighs the short-term pain caused by the involvement of a few faster-money funds.

Investors should also be aware that the warrant strike increases to $5.25 if Protara announces a six-month complete response (CR) rate of a minimum of 42% from at least 25 Bacillus CalmetteGuérin (BCG)-Unresponsive patients in their ongoing ADVANCED-2 NMIBC clinical trial with TARA-002. In this scenario, investors must exercise their warrants 90 days after the NMIBC data announcement. Protara has guided these data to be available in 1H25.

Encouraging at Three Months, Could Six Months Close Valuation Gap?

We could write several paragraphs trying to walk investors through the complex preliminary three-month NMIBC data Protara just released. This data release included patients pooled from three different study cohorts, patients who had previously received BCG and those who were BCG-naive, patients who had carcinoma in situ (CIS), and those with CIS with papillary involvement (CIS +Ta/T1). The company presented CR rates across all these patient groups. However, from such a small sample size, the only meaningful conclusions we see are that TARA-002 looks active, and the CR rates are encouraging, with lots of room for improvement six months after re-induction.

Arguably, the biggest takeaway from the NMIBC data was that they were good enough to convince their largest shareholder, Baker Bros, to re-invest and attract notable new investors such as RA Capital and Acorn, among others. These funds are making a bet that Protara can achieve a more competitive CR rate (>50% at six months?) in future data reveals from ADVANCE-2. With a market cap just over $100mm, Protara looks affordable relative to its development-stage NMIBC peers Immunity Bio (Nasdaq: IBRX) at $3.5b, CG Oncology (Nasdaq: CGON) at $2.5b, and EnGene Holdings (Nasdaq: ENGN) at $680mm. Can Protara’s valuation fall more in line with its NMIBC peers off positive six-month data from ADVANCE-2? In our opinion, that’s the bet the smart money funds are making.

Looking ahead, the next NMIBC data release by Protara will be ten patients from ADVANCE-2 at six months. Again, a small sample size, but in these data, patients who did not respond at three months after their first course of TARA-002 will be eligible for re-induction. This is referred to as salvage, and based on the studies performed by Protara’s NMIBC peers, additional CRs generally come in the salvage setting. Protara has guided these data to be available in 2H24. The bigger data reveal from ADVANCE-2 will be in 1H25 when a futility analysis is performed after a minimum of 25 BCG-Unresponsive patients reach six months post TARA-002 treatment. Protara hasn’t specified what CR rate will determine a go / no-go decision. Still, investors should look no further than the warrant re-pricing trigger, a CR rate of a minimum of 42%, to indicate what expectations the company needs to meet and ideally exceed.

Downside Protection

Protara’s recent downpour of news also included an encouraging regulatory update on the company’s IV choline program. IV choline is a substrate replacement therapy for patients on parenteral nutrition (PN) who are at high risk of developing choline deficiency leading to liver disease (steatosis and hepatocellular carcinoma). According to the company, FDA has agreed to a single pivotal study with a surrogate endpoint (plasma choline concentrations) for approval. There are already Phase 2 data demonstrating IV choline significantly improves plasma choline in PN patients. FDA’s decision to only require a biomarker endpoint versus a functional endpoint is a big win for Protara and makes this a relatively low-risk orphan disease opportunity.

Affordable NMIBC Story With a Pipeline and a Balance Sheet

Trading around its cash balance, Protara looks like an affordable NMIBC bet. Consider that EnGene, with a valuation 6x Protara, is only 9-12 months ahead in development. NMIBC is a very competitive indication and in our opinion TARA-002 will need to maintain, but more likely improve upon the early CR rates recently shared, in order to re-rate in line with its peers. We think that is the bet the deal participants are making and one that our audience might find interesting.